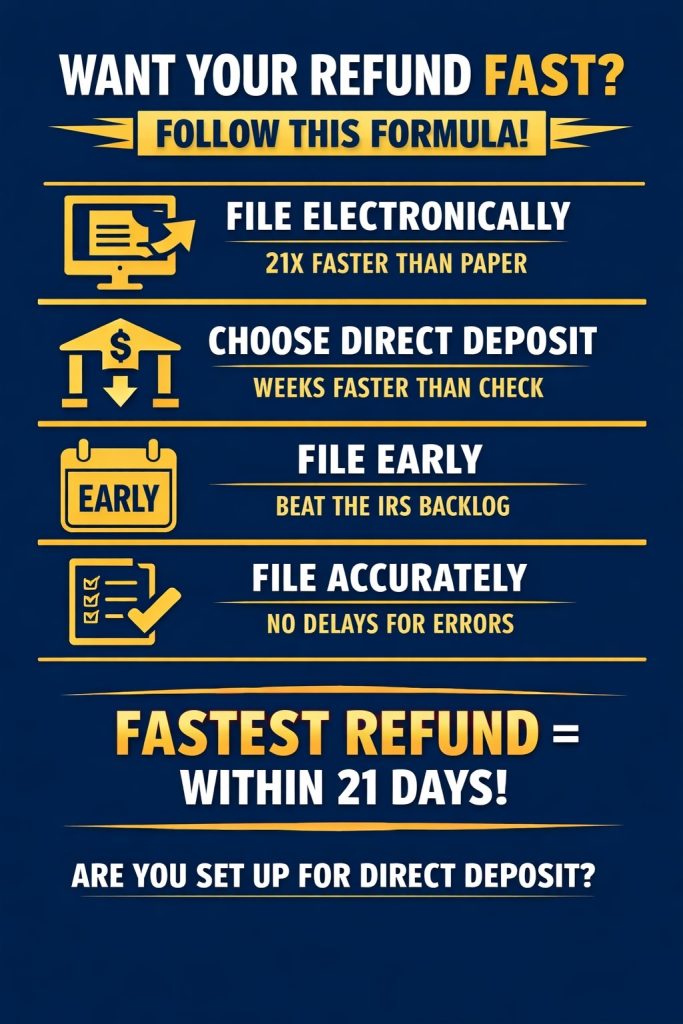

Want Your Refund FAST? Follow This Proven IRS Formula

Every tax season, the same question dominates: “How can I get my refund faster?”

While no one can force the IRS to move instantly, there is a proven formula that consistently produces the fastest possible refund timelines.

If you want to avoid unnecessary delays, follow these four steps.

The Fastest Refund Formula (Backed by IRS Processing Data)

1. File Electronically

Electronic returns are processed over 20 times faster than paper returns.

Paper returns must be manually opened, scanned, and reviewed—often adding weeks or months to processing.

Bottom line:

✔ E-file = fastest IRS intake

2. Choose Direct Deposit

Refunds sent by direct deposit are issued significantly faster than paper checks.

Paper checks require:

- Manual printing

- Mailing

- Delivery time

- Risk of delays or loss

Bottom line:

✔ Direct deposit = weeks faster than a check

3. File Early

Early filers face:

- Less IRS backlog

- Fewer system bottlenecks

- Faster movement through processing queues

Late-season filers compete with millions of returns during peak volume.

Bottom line:

✔ Earlier filing = shorter wait times

4. File Accurately

Errors trigger delays.

Common issues that slow refunds:

- Incorrect income figures

- Missing forms

- Math errors

- Identity or verification mismatches

Even small mistakes can push your return into manual review.

Bottom line:

✔ Accurate returns move faster through IRS systems

How Fast Is “Fast”?

Most taxpayers who:

- File electronically

- Choose direct deposit

- File early

- Submit an accurate return

👉 Receive their refund within 21 days, according to IRS guidelines.

Some receive refunds even sooner—but 21 days is the standard benchmark for smooth processing.

Are You Set Up for Direct Deposit?

If you’re still choosing a paper check, you’re voluntarily slowing your refund down.

Before you file, confirm:

- Your bank routing number is correct

- Your account number is accurate

- The account is open and able to receive ACH deposits

One incorrect digit can cause major delays.

There’s no secret trick—just a proven process.

E-File + Direct Deposit + Early Filing + Accuracy = Fastest Possible Refund

Want real-time updates, transcript explanations, and refund timing insights?

Stay connected and follow Refund Talk throughout tax season.