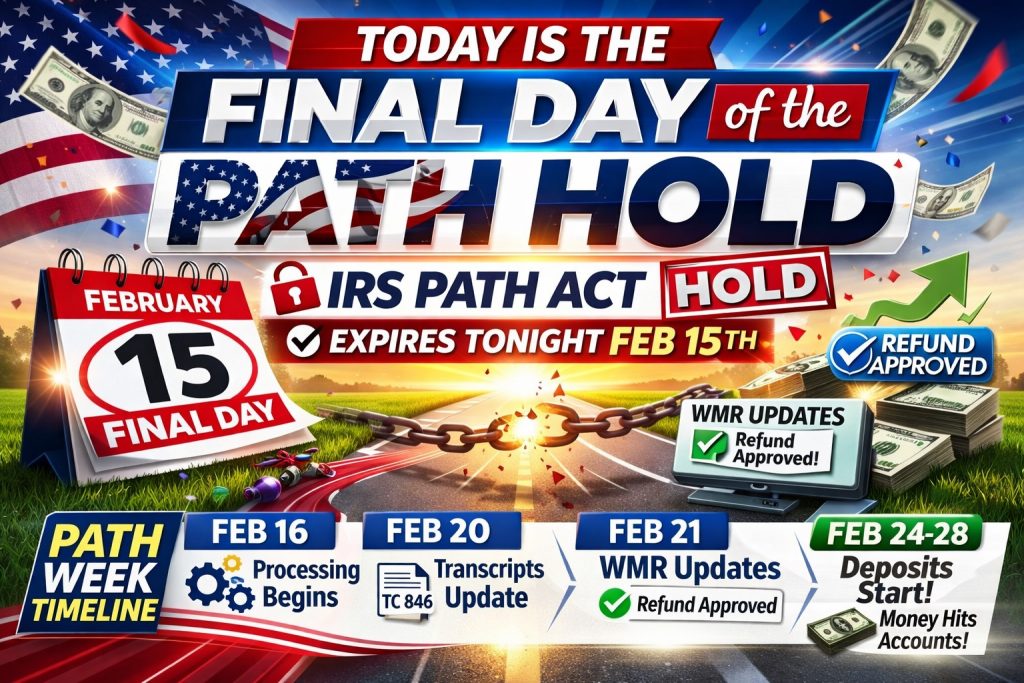

Today, February 15, 2026, marks the final day of the annual IRS PATH Act refund hold — one of the most important dates of the entire tax season for early filers claiming refundable credits.

If you’ve been stuck on the PATH message in Where’s My Refund?, this is the turning point.

Starting tomorrow, the IRS is legally allowed to begin releasing refunds that have been held back since January.

Let’s break down exactly what this means and what happens next.

What Is the IRS PATH Act Hold?

The PATH Act (Protecting Americans from Tax Hikes Act) requires the IRS to delay refunds for taxpayers who claim:

- Earned Income Tax Credit (EITC)

- Additional Child Tax Credit (ACTC)

This law was created to reduce fraud and give the IRS extra time to verify income and dependent claims before issuing refunds.

That’s why so many early filers see a message like:

“Your return has been received and is being processed under the PATH Act…”

February 15 Is the Deadline — Not the Refund Date

It’s important to understand this:

✅ The IRS hold ends after February 15

❌ That does not mean refunds are issued instantly on February 16

The IRS cannot release PATH refunds before February 15, but processing still takes time once the hold lifts.

Think of February 15 as the gate opening — not the finish line.

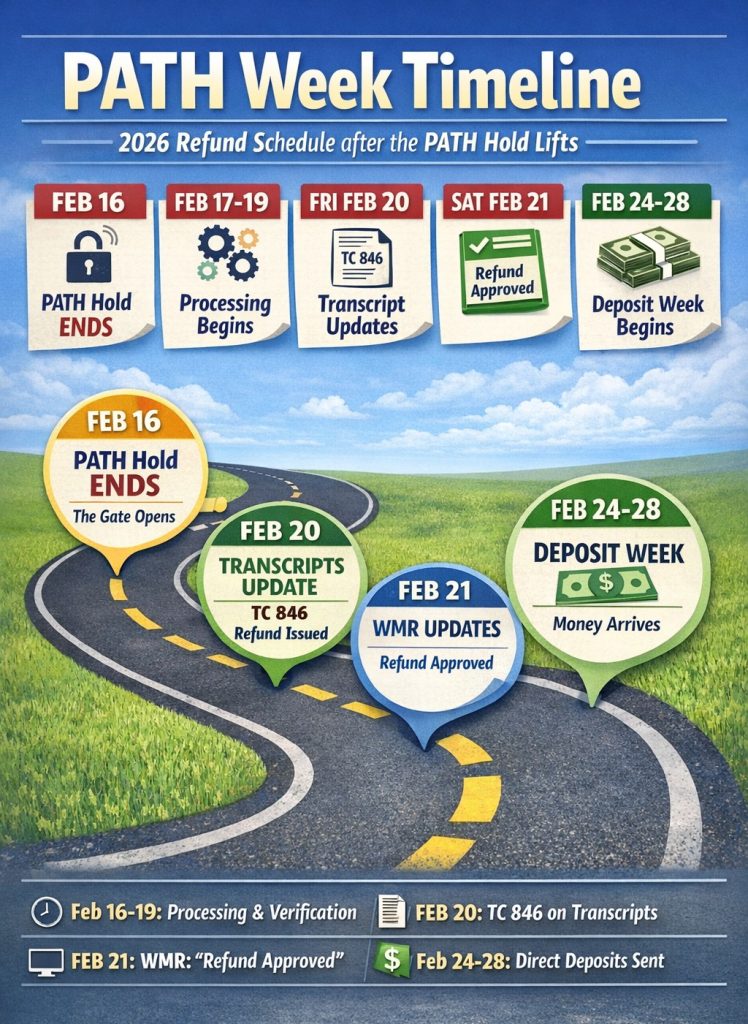

Why 2026 Timing Matters: Weekends + Holidays

In 2026, the calendar plays a big role in how quickly refunds will move.

Here’s how things line up:

- February 15 falls at the end of the hold period

- The IRS then needs a few business days to restart PATH refund processing

- Banks and direct deposit systems don’t post instantly over weekends

Because of how weekends and the mid-February schedule align, the first major movement will not happen immediately.

When Will Transcripts Start Updating?

The first real post-PATH transcript activity is expected around:

Friday, February 20, 2026

That’s when many taxpayers should begin seeing:

- New transaction codes

- Refund release activity

- Transcript cycle updates resuming

The biggest code people watch for is:

TC 846 — Refund Issued

Once that appears, your deposit is usually not far behind.

When Will Where’s My Refund Update?

The first major PATH-related WMR status updates are expected to follow on:

Saturday, February 21, 2026

This is typically when many filers finally move from:

- “Return Received”

to - “Refund Approved”

For thousands of taxpayers, this is the first visible sign that the hold is officially over.

When Will Refund Money Start Hitting Bank Accounts?

Based on IRS timing patterns, direct deposits will begin rolling out in waves.

Expect the first deposits during:

The last week of February 2026

Most PATH refunds will begin arriving between:

- February 24 – February 28

Some taxpayers may receive funds slightly earlier depending on:

- Their bank

- Direct deposit processing

- Whether fees are being deducted from the refund

What Should You Do Right Now?

As the PATH hold ends, here’s what you should focus on:

- Check your IRS transcript for refund codes

- Watch for TC 846

- Be ready for WMR movement starting Feb. 21

- Stay calm if nothing changes immediately — updates roll out in batches

The Wait Is Almost Over

If you’ve been “walking the PATH” this season, today is a major milestone.

The hold is ending, processing is about to resume, and the first real refund wave is finally approaching.

Refund Talk will be tracking:

- Transcript updates

- Cycle code movement

- WMR approvals

- Deposit timing

So stay connected and keep checking back this week.

💬 PATH Roll Call

Are you still on the PATH message today?

Drop your transcript updates below:

- Cycle code

- As-of date

- Any refund movement

Let’s track this together.