Understanding IRS cycle codes and transaction dates is key to tracking when your tax return was processed and when specific account actions, like refunds or adjustments, occurred. These codes, found on your IRS account tax transcript, provide a timeline of IRS activity. This guide explains how to decode IRS cycle codes and transaction dates step-by-step, helping you stay informed about your tax status.

What Are IRS Cycle Codes and Transaction Dates?

Cycle codes are 8-digit numbers on your tax transcript that indicate when the IRS processed your tax return or account updates. Transaction dates, listed next to specific IRS event codes (e.g., Code 846 for Refund Issued), show the exact calendar date an action was recorded on your account. Together, these codes help you track IRS processing timelines and anticipate updates like refunds.

By decoding these codes, you can pinpoint critical tax events and better manage your financial planning.

Step 1: Decoding IRS Cycle Codes

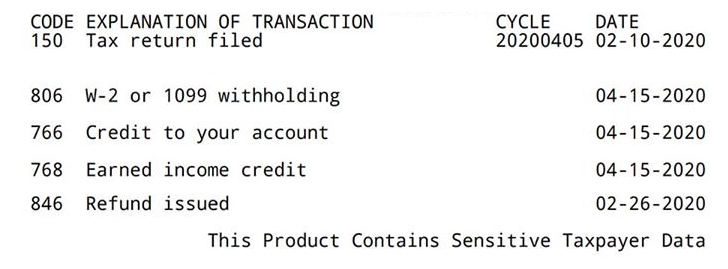

Cycle codes appear in the transaction section of your IRS account tax transcript and follow an 8-digit format: YYYYWWDD. Here’s how to break it down:

- YYYY (First 4 Digits): The tax year. For example, “2024” refers to the 2024 tax year.

- WW (Next 2 Digits): The week of the year (01 to 52). For instance, “06” indicates the 6th week, typically early February.

- DD (Last 2 Digits): The IRS processing day within the week:

- 01: Friday

- 02: Monday

- 03: Tuesday

- 04: Wednesday

- 05: Thursday (used for weekly-processed accounts)

Example: A cycle code of 20240604 means the IRS processed your return or account update on Wednesday during the 6th week of 2024 (early February).

Step 2: Understanding Transaction Dates

Transaction dates appear next to specific IRS event codes, such as:

- Code 150: Tax return filed and tax assessed.

- Code 846: Refund issued.

- Code 570: Refund hold placed.

These dates reflect the exact calendar date when a specific action was recorded on your account. For example, if Code 846 (Refund Issued) has a transaction date of “02-15-2024,” it means your refund was issued on February 15, 2024.

Key Difference: The cycle date indicates when the IRS processed a batch of returns or updates, while the transaction date specifies when a particular action (e.g., issuing a refund) was logged for your account.

Step 3: Daily vs. Weekly Posting

The last two digits of the cycle code also reveal whether your account is processed on a daily or weekly schedule:

- Daily Accounts (Ending in 01–04): These accounts are updated Monday through Friday, corresponding to the processing days (Friday, Monday, Tuesday, or Wednesday).

- Weekly Accounts (Ending in 05): These accounts are updated once a week, typically on Thursday.

Knowing whether your account is daily or weekly helps you predict when to expect updates, such as refund approvals or resolution of holds.

Why Decoding IRS Cycle and Transaction Dates Matters

Understanding cycle codes and transaction dates allows you to:

- Track Processing Timelines: Know exactly when your return was processed or when actions like refunds were recorded.

- Anticipate Refunds: Cycle codes help estimate when your refund might be issued based on IRS processing schedules.

- Resolve Issues: Spot delays (e.g., holds indicated by Code 570) and follow up with the IRS if needed.

- Plan Finances: Use transaction dates to confirm payments or credits applied to your account.

Tips for Using Cycle and Transaction Dates

- Cross-Reference with IRS Resources: If a code or date is unclear, consult the IRS’s Transaction Code Pocket Guide or transcript FAQs for detailed explanations.

- Check Your Transcript Regularly: Access your transcript via irs.gov/transcripts to monitor updates, especially during tax season.

- Consult a Professional: If you’re unsure about specific codes or delays, a tax professional can provide expert analysis.

- Use Online Tools: Search for “IRS refund schedule” to find tools that estimate refund timelines based on cycle codes.

Decoding IRS cycle codes and transaction dates empowers you to track your tax return’s processing and understand key account events. By breaking down the 8-digit cycle code (YYYYWWDD) and analyzing transaction dates next to IRS event codes, you can stay informed about your tax status and anticipate refunds or updates. Regularly check your IRS account tax transcript and use official IRS resources for clarity.

Visit irs.gov/transcripts to access your transcript and start decoding your tax information today!