Getting a copy of your IRS tax transcript is one of the fastest ways to check your tax return processing, verify income, monitor refund updates, and confirm what the IRS has on file for you. Thankfully, the IRS offers multiple secure options — online, by mail, or by requesting help from a tax professional.

Below is a simple guide to get your transcripts quickly and safely.

What Is an IRS Tax Transcript?

A tax transcript is a summary of your tax return records — including filing status, adjusted gross income (AGI), refund information, IRS codes, and any updates added to your file during processing.

Transcripts are most useful when:

- Checking your refund status beyond “Where’s My Refund?”

- Verifying income for loans or FAFSA

- Filing future tax returns (AGI verification)

- Understanding IRS review or delays (codes such as 570, 971, 846)

Ways to Get Your IRS Tax Transcript

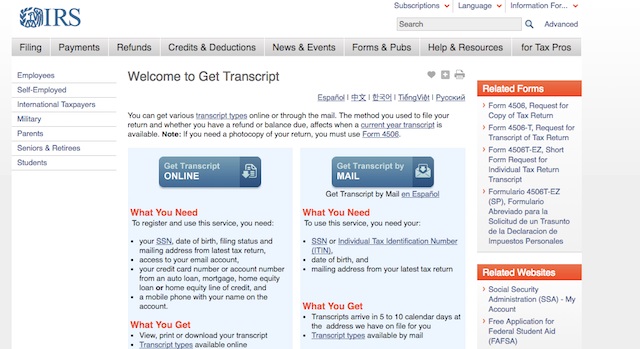

Get Transcript Online (Fastest Option)

You can instantly view and download:

- Account Transcript

- Return Transcript

- Record of Account

- Wage & Income Transcript

- Verification of Non-Filing Letter

Requirements:

- Photo ID + selfie verification (via ID.me)

- Email & mobile phone

- Social Security number

How to Access:

https://www.irs.gov/individuals/get-transcript

Once logged in, select the transcript year and type you need.

Get Transcript by Mail (5–10 Business Days)

You can request:

- Return Transcript

- Account Transcript

You will receive a paper copy by USPS mail.

Steps:

- Visit Get Transcript by Mail on the IRS site

- Confirm your mailing address

- Select the year needed

No login is required — just your SSN and mailing address.

Call the IRS

You can order by phone using the automated system:

IRS Transcript Request Line: 1-800-908-9946

Expect delivery in 5–10 days.

Tip: Use the exact legal name and address from your recent tax return.

Submit Form 4506-T

This method allows you to request multiple transcript types at once — including Wage & Income transcripts.

https://www.irs.gov/forms-pubs/about-form-4506-t

Mail or fax the completed form to the IRS.

Processing time: up to 3 weeks

Which Transcript Do You Need?

| Transcript Type | Best For | Availability |

|---|---|---|

| Account Transcript | Refund delays, IRS codes & processing status | Most recent + 10 prior years |

| Return Transcript | Loan/FAFSA income verification | Current year + last 3 years |

| Record of Account | Full details; audits or amendments | 3 years |

| Wage & Income | Lost W-2, 1099, 1098 | Full history after July |

| Verification of Non-Filing | Proof return wasn’t filed | Current year + prior 3 years |

Taxpayers tracking refund updates should check Account Transcript first.

How Long Until Transcripts Update?

| Processing Type | First Transcript Update | When Refund Code Usually Shows |

|---|---|---|

| E-Filed Return | 5–10 days after IRS acceptance | Before WMR updates |

| Paper Return | 4–6 weeks | Much later due to manual entry |

Daily accounts update Tues/Wed

Weekly accounts update Fri/Sat

Security Tip

If your IRS account is locked or cannot verify identity:

- Try a different phone number

- Ensure name & address match your return

- Upload clearer ID images

You can also request by mail if online doesn’t work.