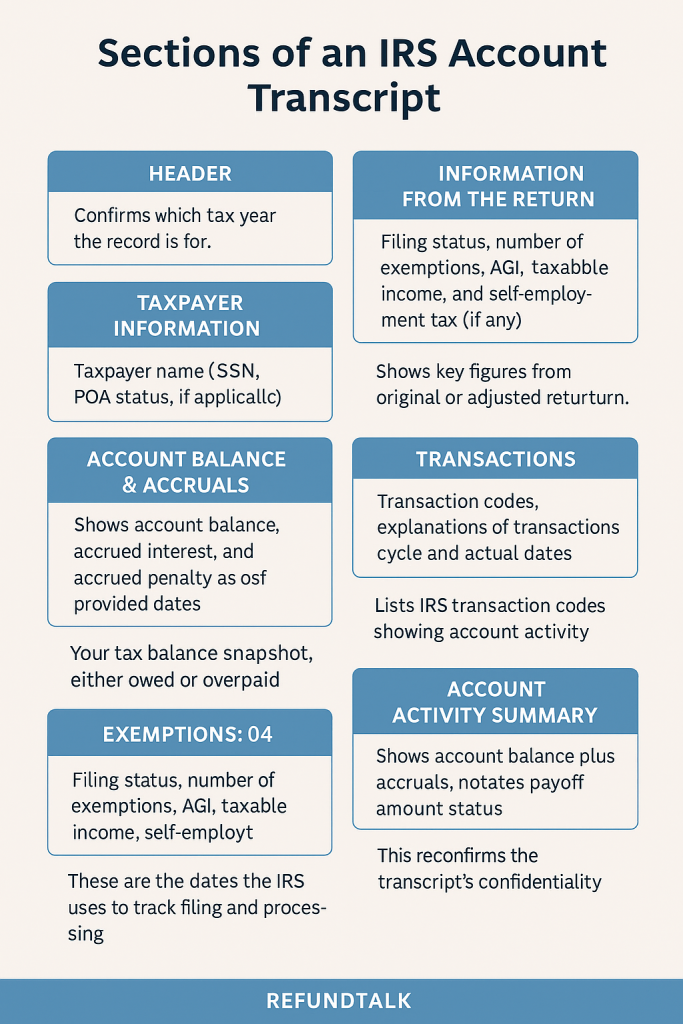

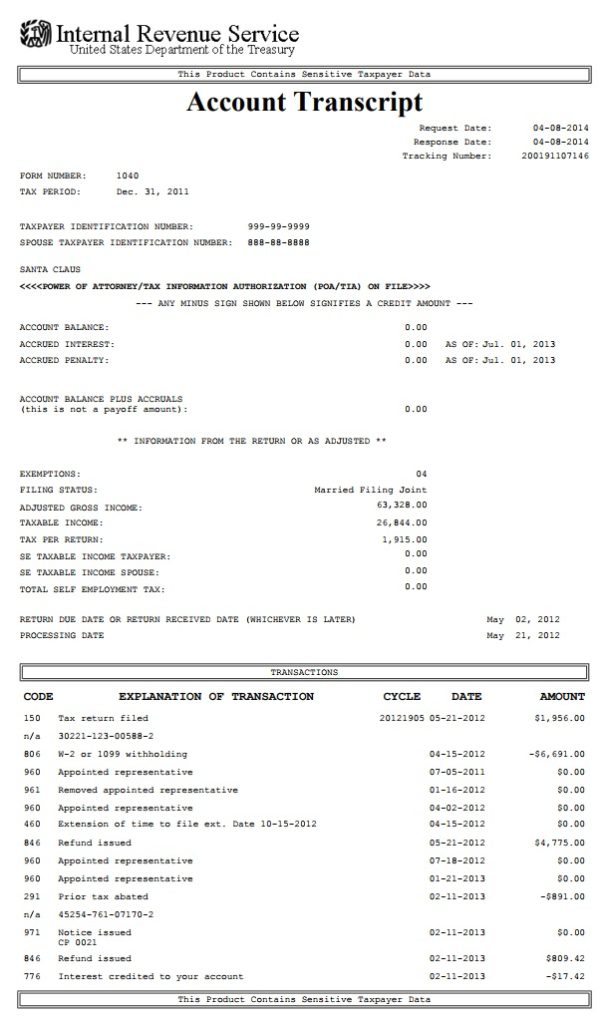

Header Section

What It Includes:

- IRS logo and title: “Account Transcript”

- Request Date and Response Date

- Tracking Number

- Tax Period (e.g., Dec. 31, 2023)

- Form Type (e.g., 1040, 1040A, 1040EZ)

Meaning for Taxpayers:

This confirms which tax year the transcript covers and when it was generated. It’s like the transcript’s “cover page.”

What to Look For:

- Make sure the tax period matches the year you want.

- Note the request and response date—this tells you when the IRS produced the file, which affects how current the data is.

Taxpayer Information Section

What It Includes:

- Taxpayer name(s)

- Taxpayer Identification Number (SSN or ITIN, often masked)

- Spouse’s name and SSN (for joint returns)

- Address (if present)

- Power of Attorney/Tax Information Authorization status (if any)

Meaning for Taxpayers:

This identifies whose account the transcript belongs to and whether someone (like a tax pro or representative) has authorization on file.

What to Look For:

- Confirm the name and masked SSN match your records.

- If you have a representative, ensure it shows as “POA/TIA on file.”

3. Account Balance & Accrual Section

What It Includes:

- Account Balance (total owed or credit)

- Accrued Interest and Accrued Penalty

- Dates “as of” which those amounts were calculated

Meaning for Taxpayers:

This is the IRS’s snapshot of what you owe (or are owed) on the date listed. A minus sign (–) means a credit or refund.

What to Look For:

- “0.00” means the account is fully settled.

- A negative balance (–) indicates a refund or overpayment credit.

- A positive balance means you owe.

- Note “As of Date” — interest and penalties grow from this date forward.

Information From the Return (or As Adjusted)

What It Includes:

- Filing Status (e.g., Married Filing Jointly)

- Number of Exemptions/Dependents

- Adjusted Gross Income (AGI)

- Taxable Income

- Tax Per Return

- Total Self-Employment Tax (if any)

Meaning for Taxpayers:

This section shows the main figures from your filed tax return (or IRS-adjusted amounts if changes were made).

What to Look For:

- Compare AGI and Taxable Income with your filed return to ensure no IRS adjustments.

- Differences may mean an IRS correction, amended return, or math error.

- This section can confirm your income for loans, financial aid, or IRS verification.

Return Due Date / Return Received Date

What It Includes:

- “Return Due Date or Return Received Date (Whichever is Later)”

- “Processing Date”

Meaning for Taxpayers:

These show when your return was due or received and when the IRS started processing it.

What to Look For:

- The received date is key—it shows when your return officially entered the system.

- The processing date helps estimate when updates (like refund release) might occur.

Transaction Section

What It Includes:

A chronological list of IRS Transaction Codes (TCs) showing all actions on your account:

- Code: numeric IRS transaction code (e.g., 150, 846, 570)

- Explanation of Transaction: short description (e.g., “Return filed,” “Refund issued”)

- Cycle Date: IRS posting cycle (e.g., 20241205)

- Date: actual transaction date

- Amount: money associated with that action

Meaning for Taxpayers:

This is the heart of the transcript — it shows the step-by-step history of how the IRS processed your return, refund, and any adjustments.

What to Look For:

- TC 150 → your return was filed and posted

- TC 570 → a hold or pending review (refund frozen)

- TC 571 or 572 → hold released

- TC 846 → refund issued (look for this to confirm your deposit date)

- TC 971 → notice sent

- TC 290/291 → tax increased/decreased

- TC 841 → refund canceled or reversed

These codes help you understand what’s happening and when.

Account Activity Summary (Totals)

What It Includes:

- Account Balance Plus Accruals

- “This is not a payoff amount” disclaimer

Meaning for Taxpayers:

Shows your account’s current balance snapshot, including accrued interest and penalties (if any).

What to Look For:

- If the balance isn’t zero, verify whether the amount is owed or overpaid.

- The “not a payoff amount” line reminds you that interest may continue until paid.

Footer Section

What It Includes:

- Repeated disclaimer: “This Product Contains Sensitive Taxpayer Data”

- Sometimes page numbers or system identifiers

Meaning for Taxpayers:

Just confirms confidentiality and that the document is an official IRS transcript.

What to Look For:

- Nothing actionable — just verify all pages are present if printing or submitting for proof of income.

Quick Tip for Reading Your Tax Account Transcript

| Symbol | Meaning |

|---|---|

| Minus (–) | Credit or refund amount |

| Positive number | Balance due to IRS |

| Cycle Code | IRS posting week and day |

| As of Date | IRS accounting snapshot date |

| TC 846 | Refund issued (refund approved) |

| TC 570 | Refund hold / under review |