Some IRS transcript codes signal refund progress, but others mean money has been stopped in its tracks.

The 810 freeze code is one of the most stressful updates a taxpayer can see — but it doesn’t always mean something bad.

This guide explains:

- Why Code 810 appears and what it really means

- The differences between freeze and release codes

- What Code 811 + Code 971 mean after a freeze

- How to tell if you must take action vs simply wait

- The real-world timeline of a full freeze → release → refund flow

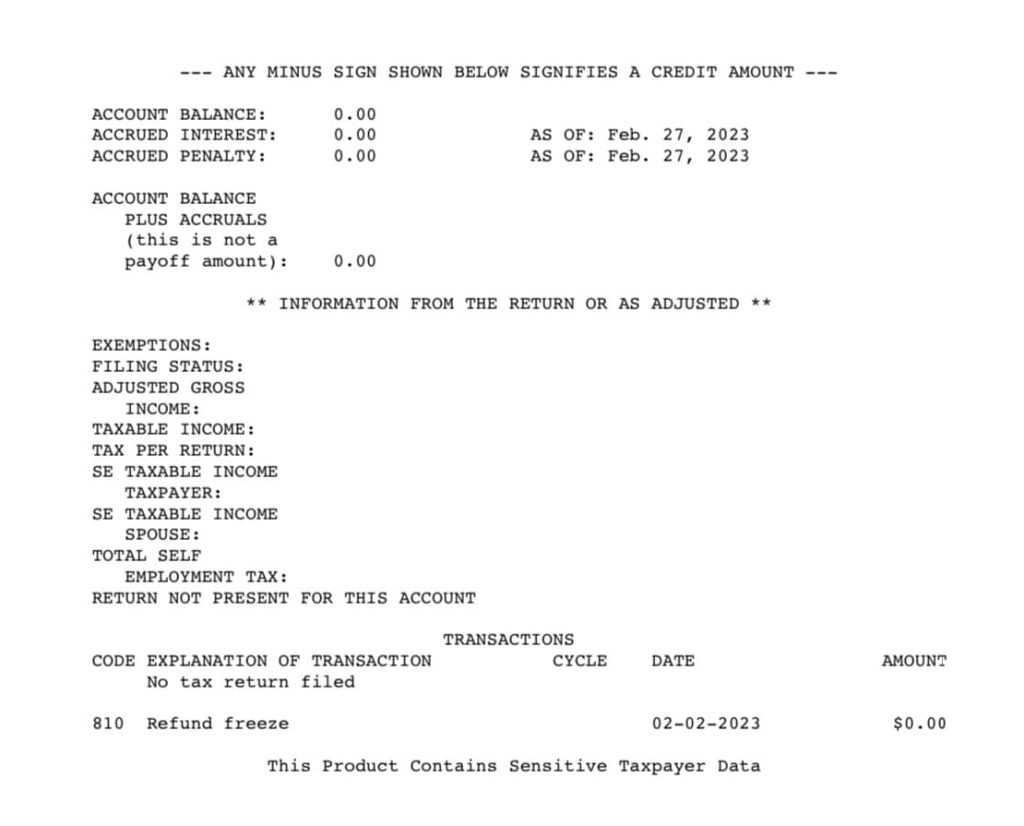

What Code 810 Really Means

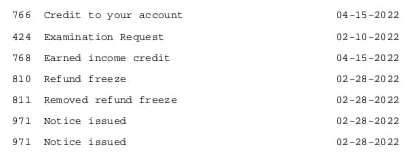

Code 810 — Refund Freeze

This is an IRS action that prevents the refund from being released until a specific issue is resolved.

Most common causes of an 810 freeze:

- Identity protection concerns (filters triggered)

- Wage/income mismatch issues

- Suspected dependent claim conflicts

- Fraud or duplicate filing signals

- Withholding/payroll inconsistencies

- Special handling of refundable credits (EITC/ACTC)

If an 810 code is present → no refund progress will occur until it clears.

Why the IRS Uses Freeze Codes

The IRS has 70+ automated flags that protect taxpayers against:

- Identity theft

- Incorrect refunds due to missing data

- Fraudulent refundable credit claims

If your return trips one, the IRS prevents the release of funds until someone verifies accuracy.

Code 811: The Official Freeze Release

Once the IRS completes its internal checks and approves your return, you should eventually see:

Code 811 — Refund Freeze Released

This is your sign that the blockage is gone and processing can continue.

810 → 811 is GOOD.

It means the IRS has validated your return.

Where Code 971 Fits Into the Freeze Timeline

Code 971 — Notice Issued

may appear:

- Before 811

- At the same time

- After the freeze clears

If paired with 811? → Notice of resolution or refund adjustment

If before 811? → IRS may need documentation from you

The Action Matrix (Your Processing Path)

| Transcript Flow | Meaning | Days to Correct |

|---|---|---|

| 810 → 811 → 846 | Freeze resolved successfully → Refund issued | 2–6 weeks |

| 810 → 971 → 811 → 846 | Info verified → Refund approved | 3–10 weeks |

| 810 → 971 (no 811 yet) | IRS needs info or still reviewing | 6–12+ weeks |

| 810 + 570 together | Freeze plus additional review | 8–16+ weeks |

Every IRS case is unique — timelines vary by backlog and complexity.

When Should You Contact the IRS?

You must call if:

✔ A 971 notice arrives requesting documentation

✔ No movement 60 days after an 810 freeze

✔ The refund amount changes unexpectedly

✔ A freeze code is paired with an audit indicator like Code 420

IRS Identity Verification Line: 800-830-5084

(Main IRS phone: 800-829-1040)

Bring:

- Transcript printout / Codes list

- Photo ID

- Prior-year return

Good Signs to Watch For

Positive movement includes:

- As of Date changes → processing updated

- Cycle code advances to a new processing week

- A new code appears, usually 811, 571, or 572

If Code 846 shows → refund approved!

Frequently Asked Question

Q: Can my refund skip 811 and go straight from 810 → 846?

A: Yes — rare but possible when freeze clears on the same posting cycle as refund issuance.

Summary Table

| Code | Meaning | Action Required |

|---|---|---|

| 810 | Refund frozen | Wait or verify ID if requested |

| 811 | Freeze removed | Good sign — refund moving |

| 971 | Notice issued | Only act if IRS requests response |

| 846 | Refund issued | Track your deposit |