Navigating the IRS tax transcript can feel overwhelming, but understanding IRS tax transcript processing dates is key to tracking your tax return and refund status. These vital timestamps, found in the “Date” column of your IRS tax account transcript, reveal when your return was processed and when specific IRS transactions occurred. In this guide, we’ll break down where to find these dates, what they mean, and how to use them to stay on top of your tax refund timeline.

What Are IRS Tax Transcript Processing Dates?

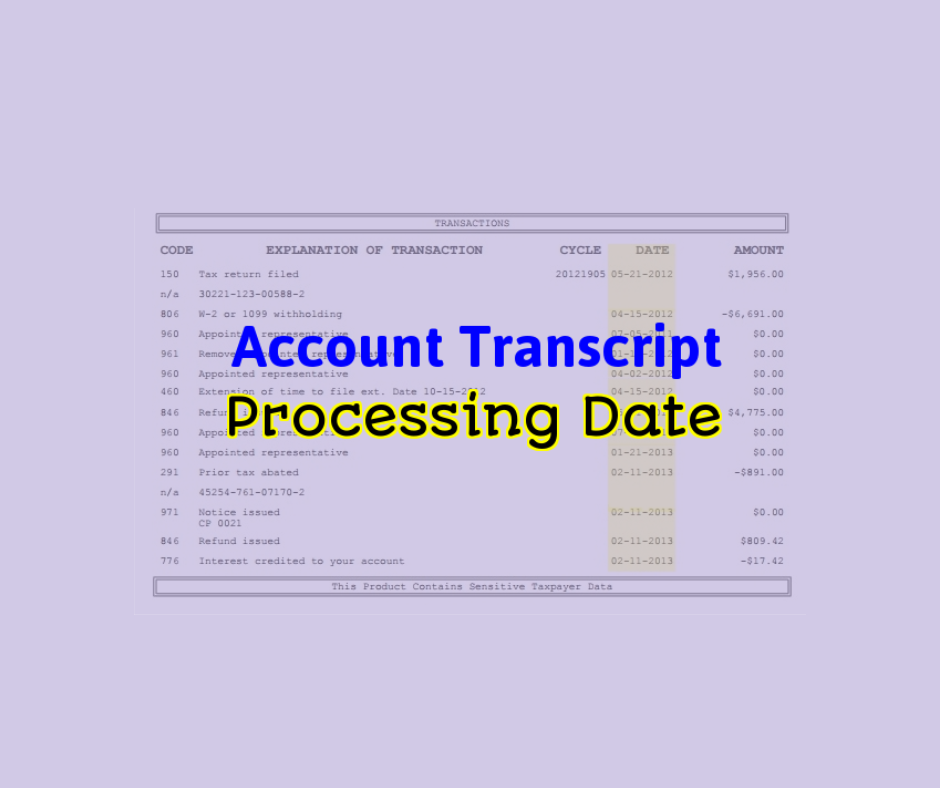

IRS tax transcript processing dates are timestamps that show critical milestones in your tax return’s journey. They appear in the “Date” column of your IRS tax account transcript, typically near the top, often next to or below the IRS cycle code. These dates fall into two main categories:

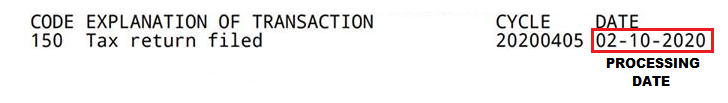

- Processing Date: A computer-generated estimate of when the IRS expects to complete processing your return, including issuing refunds or adjustments.

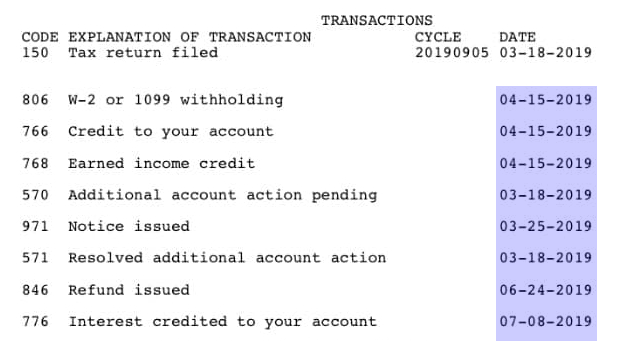

- Transaction Dates: Fixed dates tied to specific actions, like payments, assessments, or refund issuance, that document activity on your tax account.

Where to Find Processing Dates on Your IRS Transcript

To locate these dates, focus on the “Explanation and Transaction” section of your IRS tax account transcript:

- The Processing Date is usually the first date listed in the “Date” column, often appearing next to the IRS cycle code.

- Transaction Dates follow in the same column, each linked to specific IRS codes that detail events like payments or adjustments on your account.

What Do Processing Dates Mean for Taxpayers?

Understanding these dates helps you track your tax return’s progress and manage expectations for your refund:

- Processing Date: This date, typically set for a future Monday, estimates when the IRS will finalize your return, usually within 18–21 days from acceptance. It serves as an internal IRS checkpoint but may shift if complications (e.g., errors or fraud reviews) arise.

- Transaction Dates: These are fixed and reflect when specific actions occurred, such as tax payments, penalty assessments, or refund issuance. They provide a clear timeline of IRS activity on your account.

How to Use IRS Processing Dates

Here’s how taxpayers can leverage these dates:

- Estimate Refund Timing: The processing date gives a rough idea of when your refund or account changes will be finalized.

- Track Delays: If the processing date moves forward, it signals the IRS needs more time to review or process your return.

- Monitor Account Activity: Transaction dates offer a detailed history of IRS actions, helping you confirm payments, adjustments, or refund issuance.

- Clarify Delays: By comparing these dates with tools like the IRS’s “Where’s My Refund?” or IRS2Go app, you can better understand delays or the status of your return.

Key Tips for Taxpayers

- Processing Date Flexibility: Expect the processing date to fall about 18–21 days after your return enters IRS systems. However, it can change due to issues like errors, identity verification, or amended returns.

- Transaction Dates Are Fixed: Once assigned, transaction dates don’t change, making them reliable for tracking past IRS actions.

- Check Regularly: Use your transcript to confirm the latest IRS activity and align expectations for refund delivery or account updates.

- Accessing Transcripts: You can view your tax transcript via the IRS’s online portal or by requesting a mailed copy to stay updated.

Why These Dates Matter

IRS tax transcript processing and transaction dates are essential for taxpayers eager to track their refund or account changes. By understanding these timestamps, you can:

- Anticipate when your refund will arrive (typically within 21 days for e-filed returns).

- Identify potential delays caused by errors, fraud checks, or offsets (e.g., unpaid debts).

- Gain clarity on the IRS’s handling of your tax account, reducing stress during tax season.

IRS tax transcript processing dates are your roadmap to understanding your tax return’s status. The processing date estimates when your return will be finalized, while transaction dates provide a timeline of IRS actions. By regularly checking these dates and using IRS tools, you can stay informed and manage your expectations. For more help, visit IRS.gov or use the IRS2Go app to track your refund in real-time.