Every tax season, the same misconception spreads quickly online:

“The PATH Act delays refunds if you have dependents.”

That statement is not true.

Let’s clear this up once and for all.

The PATH Act has nothing to do with the number of dependents on your tax return. Instead, it applies based on specific refundable tax credits claimed on your return.

Understanding this distinction can save taxpayers a lot of confusion and unnecessary frustration.

What Is the PATH Act?

The Protecting Americans from Tax Hikes (PATH) Act is a federal law passed by Congress. One of its key provisions requires the IRS to hold certain refunds until mid-February each year.

Specifically, the IRS must delay refunds that include either of the following credits:

- Earned Income Credit (EIC / EITC)

- Additional Child Tax Credit (ACTC)

This delay is required by law.

It is not caused by:

- Your tax preparer

- Tax software

- The IRS being slow

- Errors on your return (assuming the return is accurate)

Why the PATH Act Exists

Congress implemented this rule to give the IRS extra time to:

- Verify income information

- Match wage data from employers

- Reduce identity theft and fraud

While the delay can be frustrating, it applies equally to all taxpayers who qualify for these credits.

How to Tell If the PATH Act Applies to You

You don’t need to guess — your tax return tells you directly.

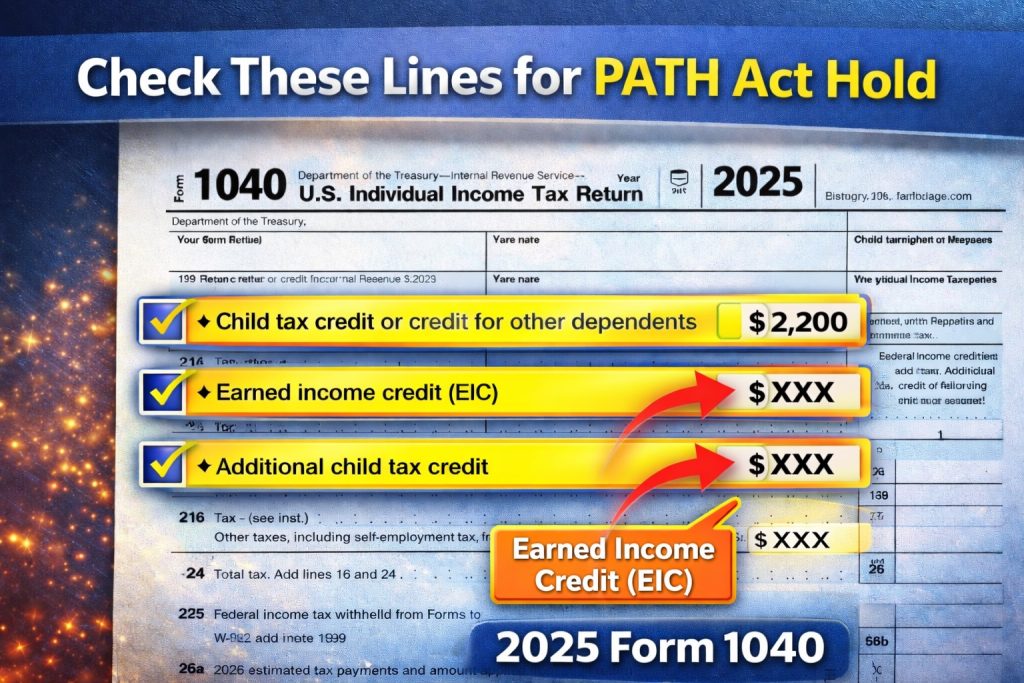

Check Your Form 1040

Look at these specific lines:

✔️ Line 27 – Earned Income Credit (EIC)

✔️ Line 28 – Additional Child Tax Credit (ACTC)

If you see a dollar amount on Line 27 or Line 28:

➡️ Your refund is subject to the PATH Act hold

If Lines 27 and 28 are blank:

➡️ Your refund is NOT subject to the PATH Act

If you only have an amount on Line 19 (Child Tax Credit) and Lines 27 & 28 are blank:

➡️ Your refund is NOT impacted by the PATH Act

Why Dependents Cause So Much Confusion

Many taxpayers associate refund delays with having children because:

- EIC and ACTC are often claimed by families

- Dependents are common on returns affected by the PATH Act

However, dependents themselves do not trigger the delay.

The determining factor is which credits you qualify for, based on:

- Income

- Filing status

- IRS eligibility rules

Not how many children are listed on your return.

Important Timing Reminder

Under the PATH Act:

- The IRS cannot issue refunds with EIC or ACTC before mid-February

- Even if you file early and your return is accepted quickly

- Even if part of your refund is unrelated to those credits

Once the hold lifts, refunds are processed in the normal order.

Bottom Line

The PATH Act is about credits, not kids.

If you want a fast, accurate answer to whether your refund is delayed:

Check Lines 27 and 28 on your Form 1040.

They tell you everything you need to know.

Understanding this upfront helps set realistic expectations and avoids unnecessary stress during tax season.