“We Have Received Your Tax Return and It Is Being Processed” vs. “Your Tax Return Is Still Being Processed”

When checking Where’s My Refund?, the IRS uses two similar-sounding messages during tax return processing:

“We have received your tax return and it is being processed.”

“Your tax return is still being processed.”

Many taxpayers assume they mean the same thing — they do not.

This page explains the key differences, what stage of the process each message represents, who is most likely to see them, and how to know if your refund is moving forward or delayed.

Quick Difference Chart

| Status Message | Stage of Processing | What IRS Is Doing | Refund Timing Outlook |

|---|---|---|---|

| We have received your tax return and it is being processed | Early Stage | Running initial automated checks including income + ID verification | Typically 1–3 weeks to next stage |

| Your tax return is still being processed | Extended Stage | Something needs additional handling before refund approval | Can add 3–12+ weeks to timeline |

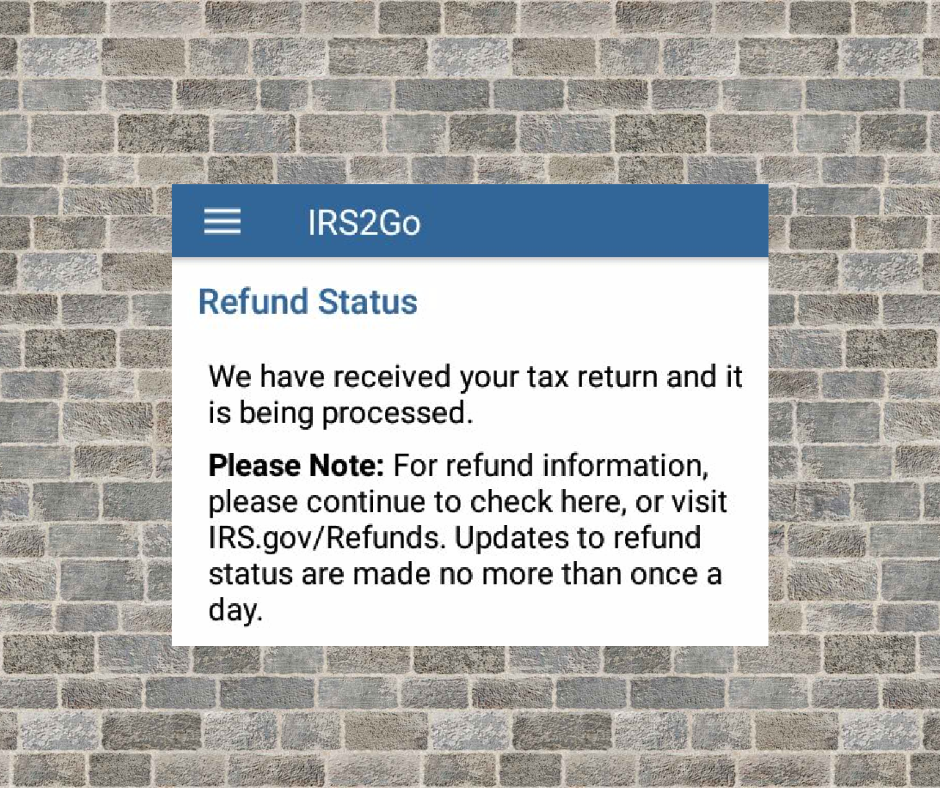

“We Have Received Your Tax Return and It Is Being Processed”

What this message really means:

- IRS has officially accepted your tax return

- Your return has been posted to the IRS master file

- IRS is running standard automated validations

- No delays, no special review at this point

- Refund is not yet approved, but processing normally

This is the normal first stage taxpayers see

Good sign — return is actively moving through the system

What the IRS is checking during this stage:

| Automatic Check | Purpose |

|---|---|

| Identity Verification | Your SSN + past year data matches |

| Wage & Income Matching | W-2/1099 filings are accurate |

| Credit Eligibility | Child Tax Credit, EITC, AOTC |

| Error Scanning | Math mismatch or missing forms |

These automated systems move quickly if everything matches.

Who commonly sees this message?

- Early filers

- Direct deposit refunds

- Returns without error or flag triggers

Typical timeline from this message:

Most taxpayers move to the next status in:

5–21 days after acceptance

You may then see:

- A refund approval status, or

- A switch to the second processing message if a review is needed

Transcript clues during this message:

| Transcript Data | Likely Status |

|---|---|

| Code 150 posted | Return filed |

| No 570/971 codes | No issues found |

| As of Date near filing date | Still initial stage |

| 846 NOT present | Refund not yet released |

What to do if you see this message:

- Nothing — simply wait

- Continue checking weekly

- Watch transcripts for new codes or As of Date movement

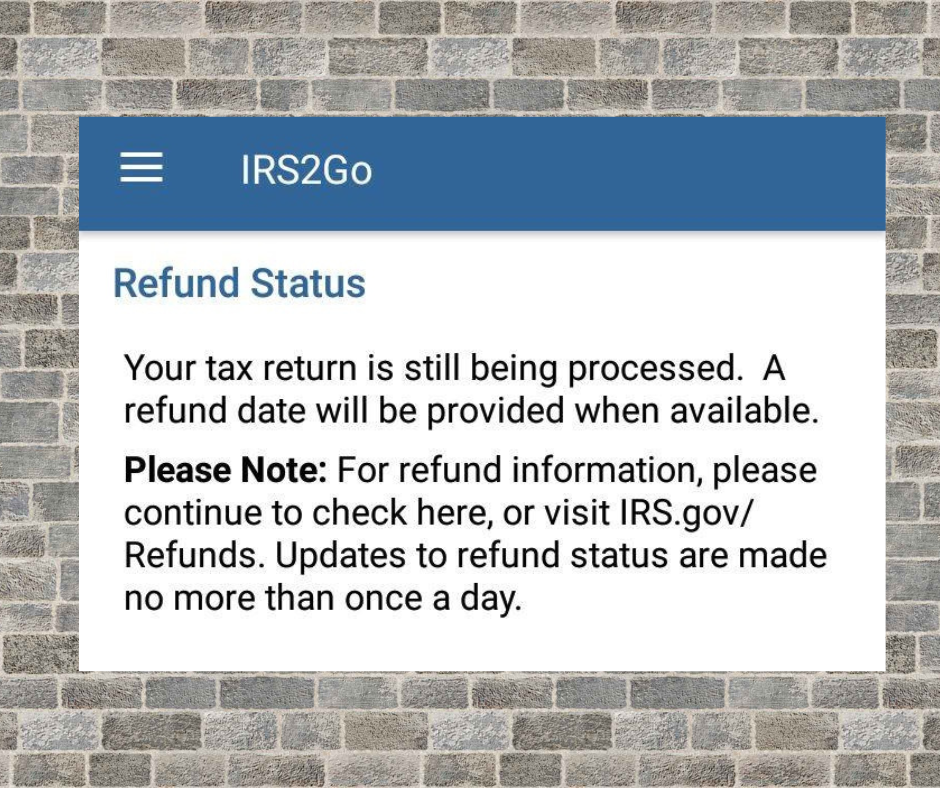

“Your Tax Return Is Still Being Processed”

What this message means:

- The IRS found something requiring further review

- Your return needs manual intervention or additional checks

- The IRS cannot approve your refund yet

- Processing is taking longer than normal

This status indicates a delayed refund, not a problem with acceptance.

Why this message appears:

Several issues commonly trigger this status:

| Cause | Transcript Clue | Delay |

|---|---|---|

| Income mismatch | Code 570 → Code 290 later | 2–12 weeks |

| ID verification concern | Code 810 | Until verified |

| Credit validation hold | 570 during PATH Act | Until mid-February |

| Dependent conflict | 971 notice issued | 4–10 weeks |

| Manual review needed | Ghost updates only | 1–6 weeks |

Who commonly sees this message?

Returns claiming:

- EITC or ACTC refundable credits

- New dependents

- Mixed income types (W-2 + 1099)

- Large refunds compared to prior year

- Identity flags or prior ID theft cases

How long will this delay last?

| Situation | Estimated Time |

|---|---|

| Standard review | 3–8 weeks |

| ID verification required | Until ID verified |

| Wage match issue | 4–12 weeks |

| IRS requested more documents | Depends on response time |

Transcript clues during this message:

| Transcript Data | Meaning |

|---|---|

| Code 570 posted | Refund on hold |

| Code 971 posted | Notice issued |

| As of Date moves forward | Active progress |

| Ghost updates | Internal system movement |

| Code 846 | Refund approved |

Transcripts reveal what WMR doesn’t disclose

When you should call the IRS:

Call if:

- No progress in 45–60 days

- You received a notice by mail and need help

- Code 810 indicates frozen refund

- Refund amount changed unexpectedly

IRS: 800-829-1040

Best time to call: 7:00–9:00 AM ET

Bottom Line — Compare the Two Refund Statuses

| Message | Meaning in Plain English | What You Should Expect |

|---|---|---|

| We have received your tax return… | You’re at the start of processing | Refund is moving normally |

| Your tax return is still being processed | IRS needs more time | Refund timeline is extended |

Neither message means:

- Your return was rejected

- You’re being audited

- You won’t receive your refund

They simply indicate where you are in the process.