When you check the Where’s My Refund tool, two messages often confuse taxpayers: “Your tax return is still being processed” and “Your tax return is being processed.” Although they sound almost the same, they mean very different things. Let’s unpack the difference in the simplest terms.

What “Still Being Processed” Tax Refund Status Means

This message means your return is doing more than just routine processing — there’s something the IRS is reviewing or checking.

What triggers this message?

- The IRS needs to verify your identity

- Your refund includes credits the IRS is watching (like the Earned Income Tax Credit or Additional Child Tax Credit)

- Wage or withholding info doesn’t match IRS data

- A prior offset (past-due debt) may be affecting your refund

What it means for your refund:

- The standard 21-day refund timeline no longer applies

- You may see this message for several weeks or more

- If the IRS resolves the issue, your status may change to “Being Processed”, or you may get a letter asking for more info

What should you do?

- Keep an eye on your mail — you might get a letter with instructions

- Log into your IRS account or check your transcript for codes (example: TC 570)

- Don’t worry immediately, but if you see this message for 3 or more weeks without change, consider calling the IRS

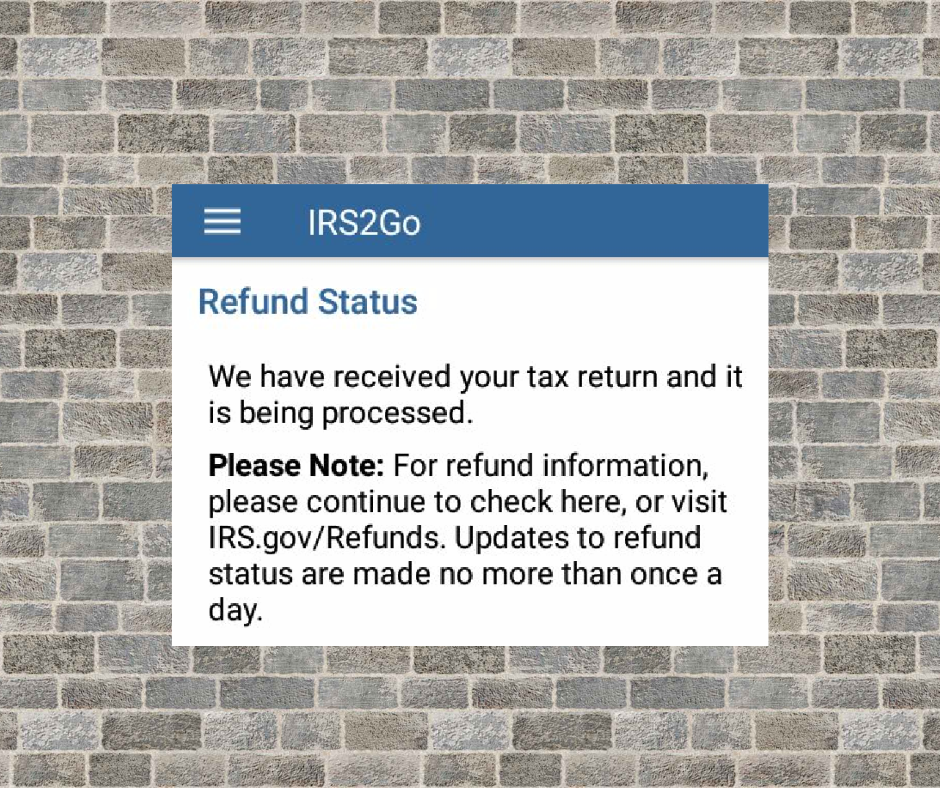

What “Being Processed” Tax Refund Status Means

This message means your return is now in the final stages — the IRS has cleared any major issues and is preparing to issue your refund.

What triggers this message?

- Any hold (code) has been removed

- Your account is ready for payment scheduling

- You’re moving closer to seeing a refund date or deposit

What it means for your refund:

- Your refund is likely only a few cycle-weeks away

- Check your transcript for code 846 (Refund Issued) — once you see it, your refund is on its way

- If you filed electronically and chose direct deposit, funds may arrive soon after code 846 appears

What should you do?

- Monitor your bank account around the date shown in your transcript

- Be ready for the deposit (some banks post it the same day, others the next business day)

- If no funds show within 3 business days of the 846 date, follow up with your bank and the IRS

Simple Comparison Table

| Status Message | What It Means | Next Step |

|---|---|---|

| “Still Being Processed” | Return held for review or verification | Watch for letters, check transcript codes |

| “Being Processed” | Return cleared major reviews and is almost done | Monitor for refund date or deposit |

Why This Matters

Understanding which status message you’re seeing helps you:

- Stop guessing when your refund will arrive

- Know if you need to take action or just wait

- Reduce worry and avoid calling the IRS unnecessarily

Final Takeaway

- If your status says “Still Being Processed,” expect more time — something is being reviewed.

- If it changes to “Being Processed,” your refund is likely weeks away, and you should watch for code 846 or a deposit.

Stay focused, check your transcript, and you’ll know exactly where your refund stands.