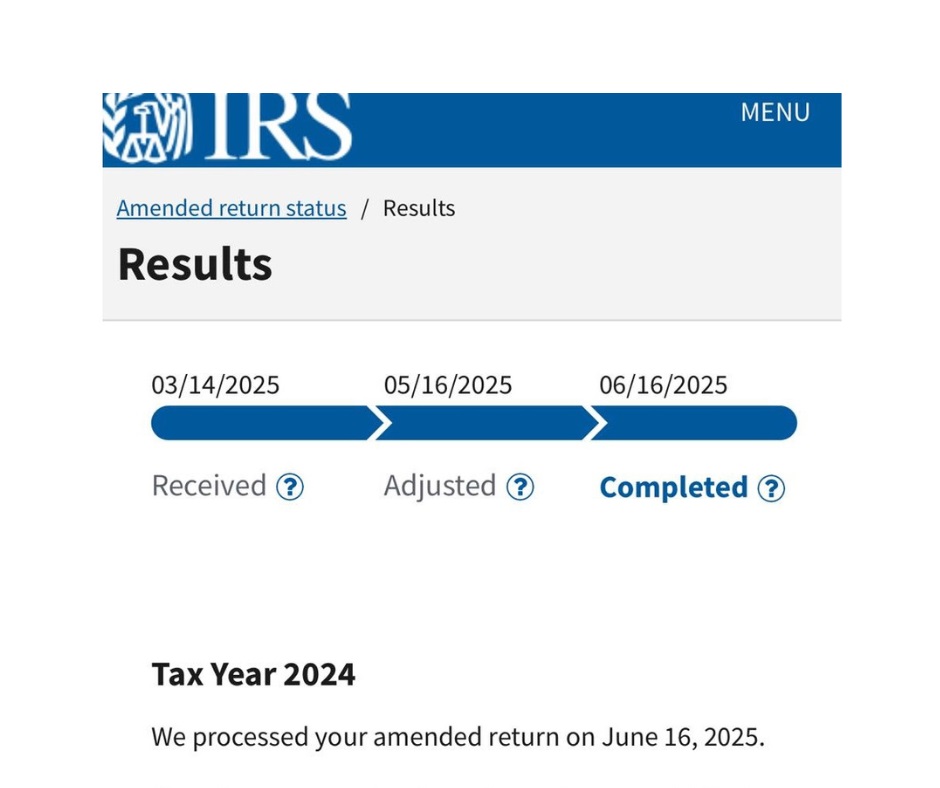

It is common for taxpayers to see the status update to “Completed” and assume a refund should arrive immediately. However, this status only confirms that the IRS has finished adjusting the return.

What “Completed” Actually Means

- IRS has fully processed your Form 1040-X

- Changes have been finalized in the system

- A closing notice has been or will be mailed

This does not confirm that the refund has been issued yet.

Final Payment Still Must Be Released

Once processing is marked completed, the refund still goes through:

- Treasury accounting review

- Offset review for past debts

- Payment scheduling for check or deposit

- Mail or banking delivery timelines

These steps can take an additional 1 to 4 weeks.

Possible Delays After Completion

| Issue | How It Affects You |

|---|---|

| Refund subject to offset | Treasury may reduce or fully take refund |

| Address mismatch | Paper check may be returned or delayed |

| Bank rejects direct deposit | IRS reissues as check |

| Notice delivery delays | Refund held until notice processed |

What to Watch on Transcripts

Refund is close once:

- Code 846 posts (Refund Issued)

- As Of Date updates forward

- 971 letter shows with a recent date

If “Completed” shows for more than 6 weeks with no refund activity, contacting the IRS is appropriate.

Summary

The “Completed” status means the amendment has been fully processed, but payment issuance still requires additional time. Refunds typically arrive within a few weeks after completion, but delays can occur if offsets or banking issues exist.

If You Found The Information Here Was Useful Please Consider Sharing This Page!