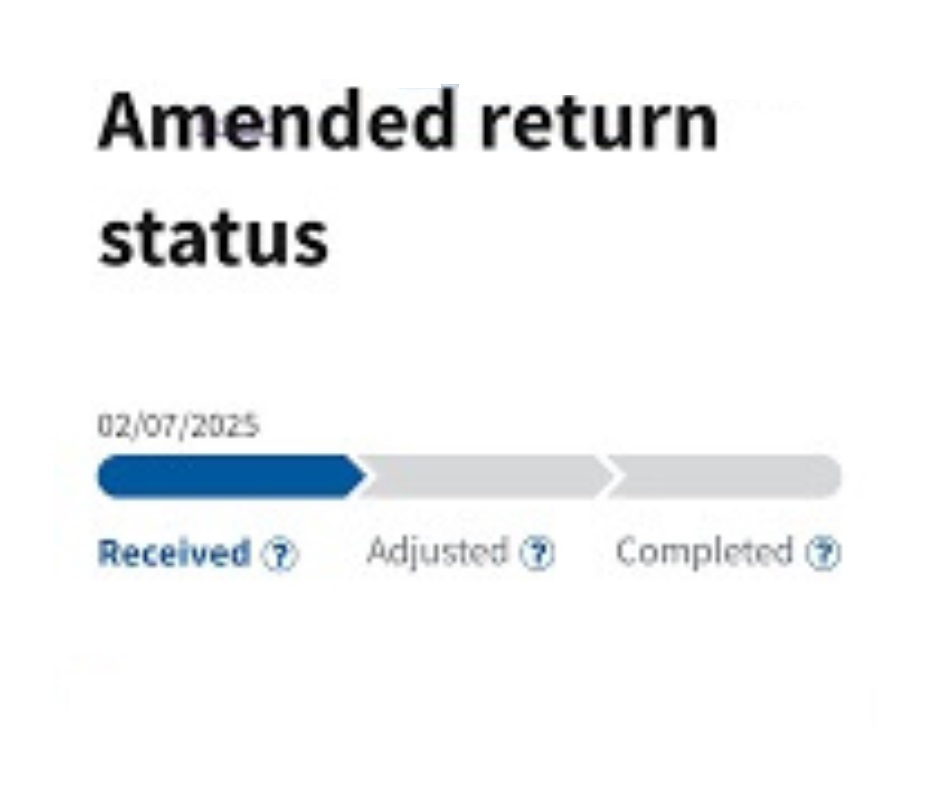

Seeing “Received” for months is the #1 complaint from taxpayers waiting on amended refunds.

Unfortunately — it’s normal.

Why “Received” Lasts So Long

Once a 1040-X is logged into the IRS system, it must wait in line for:

- A manual caseworker review

- Data entry (paper amendments)

- Cross-checking income + credits

- Wage verification (W-2s, 1099s)

- Fraud & identity screening

This part can take 10–16+ weeks alone.

Common Triggers for “Stuck” Processing

| Reason | Delay Impact |

|---|---|

| Added dependents | Extra document verification |

| Claimed refundable credits | Higher fraud review |

| Earned Income Credit changes | W-2 proof required |

| Paper-filed amendment | Longest processing |

| Multiple-year amendment | Routed to a special team |

Here’s When to Start Worrying

If any apply:

- 20+ weeks and no transcript activity

- 570 code (hold) with no 571/572 release

- You received a 971 notice with no response from IRS

- No As-Of date changes in months

How to Check for Progress

- Pull your IRS Account Transcript

- Look for:

- As of Date changes

- New transaction codes

- Added credits (766/768)

- Status message updates

If nothing changes after 20+ weeks:

Call: 866-464-2050

Request: Amended Return Status Research

FAQ

Why can’t the IRS give me more details online?

Amended returns are manually handled, so data is limited.

Do amended returns process weekly or daily?

They update weekly, usually on Friday mornings.

Can contacting the IRS slow things down?

Not unless they request more documents.

Bottom Line:

“Received” may feel like you’re stuck — but it’s just the queue stage before a caseworker takes over.

If You Found The Information Here Was Useful Please Consider Sharing This Page!