Last updated for the 2026 tax filing season

The Protecting Americans from Tax Hikes (PATH) Act continues to affect millions of taxpayers every year. If you are claiming the Earned Income Tax Credit (EITC) or the Additional Child Tax Credit (ACTC), this page explains exactly what happens to your refund in 2026, why the delay exists, and when you can realistically expect movement and a deposit.

What Is the PATH Act?

The PATH Act is a federal law passed by Congress in December 2015. One of its permanent provisions requires the IRS to hold the entire tax refund for any return that claims:

- Earned Income Tax Credit (EITC)

- Additional Child Tax Credit (ACTC)

By law, the IRS cannot release these refunds before February 15, even if only part of the refund is related to these credits.

This rule has been in effect since the 2017 filing season and remains unchanged for 2026.

PATH Act Law (Plain English)

- If you claim EITC or ACTC, your entire refund is frozen

- No partial refunds are allowed

- The hold applies regardless of:

- How early you file

- Whether you e‑file or paper file

- Whether you use direct deposit

The purpose of the delay is fraud prevention. Congress gave the IRS extra time to verify wages and income information before releasing refunds.

Why the Delay Happens

Under the PATH Act:

- Employers must file W‑2s and 1099s by January 31

- The IRS cross‑checks your return against employer data

- Refunds are held until verification is complete

This extra time significantly reduces identity theft and improper payments, which historically affected EITC and ACTC at high rates.

How Many Taxpayers Are Affected?

Each year:

- ~30 million taxpayers are impacted

- $100+ billion in refunds are temporarily delayed

This is why PATH Act questions dominate early‑season refund discussions.

Is the PATH Act Permanent?

Yes.

The EITC and ACTC expansions were made permanent when the law passed in 2015. There is no sunset date, and the February 15 refund hold continues indefinitely unless Congress changes the law.

Why Do I See the PATH Message on Where’s My Refund?

You will see the PATH message if your tax return includes:

- Form 1040, Schedule EIC (Earned Income Credit), or

- Additional Child Tax Credit amount

On recent tax returns, this typically corresponds to the EITC and ACTC lines on your Form 1040.

If either credit is present, the PATH message is normal and expected.

What If I Never Got the PATH Message?

If you did not claim EITC or ACTC:

- Your refund is not subject to the PATH hold

- Your refund will be issued once processing is complete

- Normal 21‑day timelines apply (assuming no other issues)

Can My Refund Status Change Before February 15?

No.

Once the PATH message appears:

- Your refund is placed under a C‑Freeze

- The account switches to weekly processing

- No refund date will appear before February 15

PATH Act Processing Cycles Explained

All PATH‑affected returns are forced into weekly update mode, regardless of your normal cycle code.

What this means:

- Where’s My Refund updates occur on Saturdays

- Transcript updates cluster on Fridays

- Daily vs weekly cycle codes do not matter during PATH

What If I File After February 15?

If you file after February 15, 2026:

- The PATH Act does not delay your refund

- Normal IRS processing timelines apply

- Refunds are still subject to standard reviews and offsets

Why Did My Status Change on February 16?

The PATH hold lifts at 11:59:59 PM on February 15.

On February 16, many taxpayers see:

- “Still Processing”

- Two bars with no date

This is normal. It indicates the refund has re‑entered active processing.

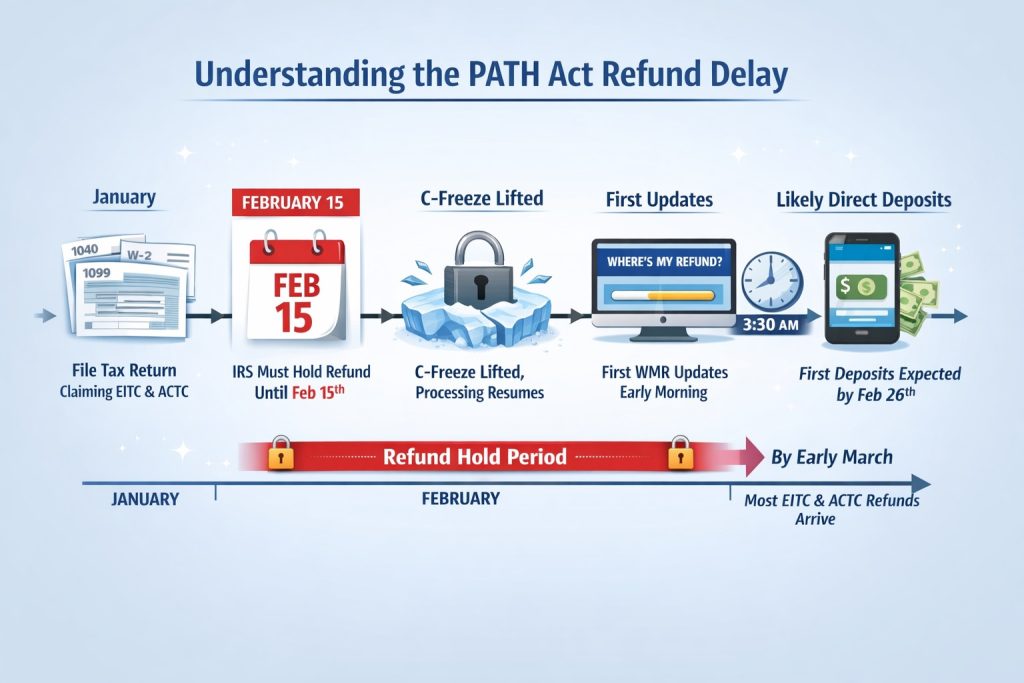

Historical PATH Act Release Pattern

Since 2017, the IRS has followed a remarkably consistent pattern:

- PATH hold lifts February 15

- First major updates appear the following Saturday

- First direct deposits usually arrive by the next Wednesday

PATH Act Timeline Chart – 2026 (Projected)

Important: These dates are projections based on IRS behavior from 2017–2025. Actual results may vary.

| Event | Date (2026) |

|---|---|

| IRS Opening Day | Monday, January 26, 2026 |

| PATH Hold Lift | Sunday, February 15, 2026 (11:59 PM) |

| Status Changes Begin | Monday, February 16, 2026 |

| First Major WMR Updates | Saturday, February 21, 2026 |

| First Likely Direct Deposit Dates | Wednesday, February 25, 2026 |

Can I Get a Direct Deposit Before February 15?

No.

Under the PATH Act:

- Refunds cannot be released early

- Hardship requests are not allowed

- Adjustments cannot bypass the hold

- Partial refunds are prohibited

The C‑Freeze is system‑controlled and non‑negotiable.

Does PATH Mean My Return Is Fully Processed?

No.

The PATH message only confirms:

- Your return was accepted

- The PATH hold is applied

Final approval occurs after February 15, when:

- A refund date appears

- A letter is issued, or

- The refund is deposited

Key PATH Act Facts to Remember

- File normally — do not delay filing

- No one can legally release your refund early

- All filing methods are treated the same

- Beware of refund advance loans tied to PATH refunds

- The delay affects your entire refund

- Filing after February 15 avoids the PATH hold

PATH-Only Refund Deposit Tracker (2026)

This tracker is designed specifically for EITC / ACTC (PATH Act) refunds. It reflects how refunds historically move after the PATH hold lifts.

Status meanings below are based on IRS behavior from 2017–2025. Dates are projections, not guarantees.

2026 PATH Refund Deposit Tracker

| Stage | What You’ll See | What It Means | Expected Timing (2026) |

| PATH Message | “Your refund is being held” | Refund is accepted but legally frozen | Jan 26 – Feb 15 |

| Hold Released | Status changes / bars reset | C-Freeze lifted at system level | Feb 16 |

| First WMR Updates | “Still Processing” or bars return | Return re-enters active processing | Feb 16–20 |

| First Approval Wave | Approved with deposit date | Refund approved for release | Sat, Feb 21 |

| First Direct Deposits | Funds hit banks | Early PATH filers paid | Wed, Feb 25 |

| Main Deposit Window | Ongoing approvals & deposits | Majority of PATH refunds issued | Feb 25 – Mar 6 |

| Late PATH Deposits | Staggered payments | Additional reviews, offsets, banks | Through mid‑March |

How to Use This Tracker

- Saturday = IRS approval day for most PATH refunds

- Wednesday = most common deposit day

- Your bank may post funds early or late

- Transcript code 846 confirms approval

If you don’t see movement by early March, your return may be subject to:

- Income verification

- Offsets

- Manual review

Bottom Line for 2026 PATH Filers

If you claim EITC or ACTC in 2026:

- Expect silence until mid‑February

- Expect movement beginning late February

- Expect deposits most commonly in late February or early March

This page will remain updated as the 2026 filing season unfolds.