The 2024 tax season is underway, and a few early taxpayers have already received notifications from both Where’s My Refund? and their tax services.

If you’ve already tackled your tax preparation ahead of schedule, stay vigilant on Where’s My Refund? The IRS is currently undergoing Hub Testing and will be accepting tax returns daily throughout the week.

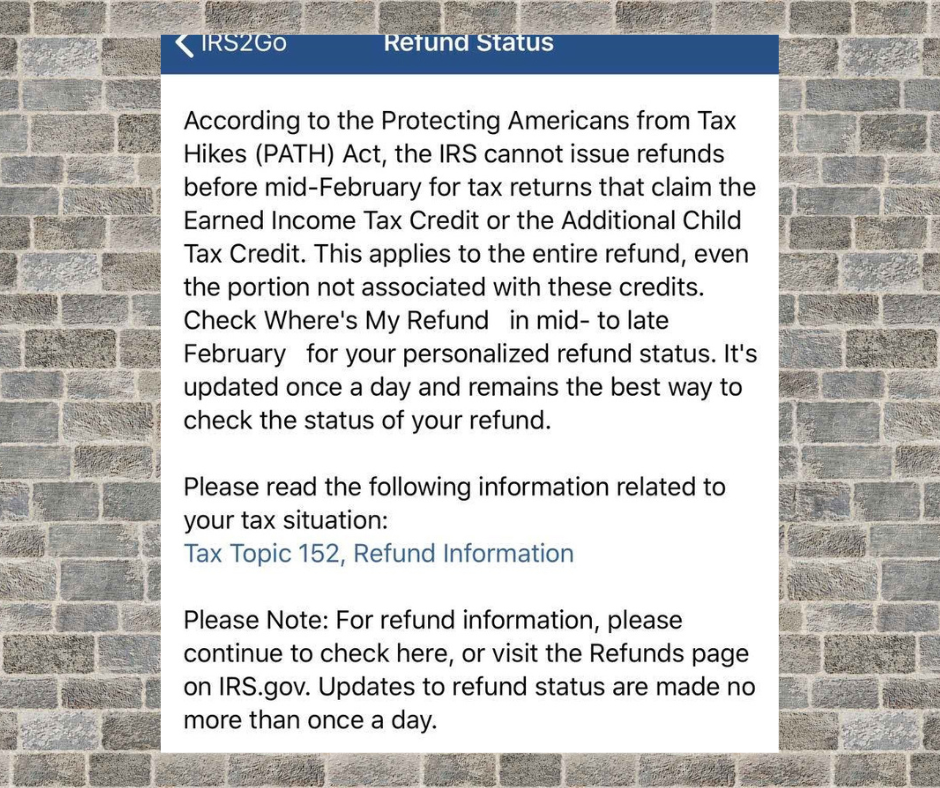

If your refund status reflects the message above while checking Where’s My Refund?, this message indicates that the IRS has accepted your tax return ahead of the opening day.

What is IRS HUB Testing?

HUB Testing, also known as the Controlled Launch, marks the initial batch processing of tax returns by the IRS. This entails selecting a handful of early tax returns from all registered tax preparers to ensure the efficiency of the software. As a routine practice, about a week before each tax season kicks off, the IRS conducts a Controlled Release Process, or HUB Testing, with various e-file providers, including free online e-file services. During this phase, a limited number of e-filed tax returns are transmitted to the IRS, leading to actual acknowledgments and rejections. These returns, randomly chosen from queued ‘batches,’ are part of the testing procedure to assess system readiness before the official opening on January 29, 2024. Importantly, this testing period encompasses not only the acceptance of e-filed tax returns but also the comprehensive processing, including the issuance of some tax refunds.

Building on patterns from past tax years, we observed that certain early-filed tax returns, that did not include the Earned Income Tax Credits and/or Additional Child Tax Credits, underwent processing during the IRS HUB testing phase. In some cases, taxpayers received their tax refunds as early as the first weeks of February, provided their tax returns were accurate, complete, and free of processing issues.

Advertisement

Click Here for information on the 2023 IRS HUB Testing!

How many tax returns does the IRS pull for test batches?

- In 2023, the IRS efficiently processed 141.1 million tax returns, with a notable 134.1 million being E-Filed returns. Impressively, the number of early-filed tax returns selected for test batches may be less than 10 million.

If my tax return is selected in the test batches will I get my tax refund any sooner?

- For tax returns not claiming Earned Income Tax Credits and/or Additional Child Tax Credits that undergo successful processing and approval in the test batches, a potential tax refund date could be as early as January 31, 2024.

- If your tax return includes Earned Income Tax Credits and/or Additional Child Tax Credits and successfully undergoes the test batches, it will remain on hold with the PATH Act message until at least February 15, 2024.

The timing of your tax refund can be influenced by various factors once the IRS receives your return. While the IRS typically processes most refunds within 21 days, there’s a chance that your refund may require additional time. Additionally, consider the duration it takes for your financial institution to credit the refund to your account or for you to receive it via mail.

Taxpayers who claim the Earned Income Tax Credit or the Additional Child Tax Credit may experience a refund hold. According to the Protecting Americans from Tax Hikes PATH Act Law, the IRS cannot issue these refunds before mid-February. The IRS expects the earliest EITC/ACTC-related refunds to be available in taxpayer bank accounts or debit cards starting February 28, 2024, if these taxpayers chose direct deposit and there are no other issues with their tax return.

Where’s My Refund?IRS.gov and the IRS2Go mobile app will be updated on February 17, 2024, for the vast majority of early filers who claimed the Earned Income Tax Credit or the Additional Child Tax Credit. Before February 17, some of these filers may see a projected date or a message that the IRS is processing their return. These taxpayers will not see a refund date on Where’s My Refund? or through their software packages until then. The IRS, tax preparers, and tax software will not have additional information on refund dates, so Where’s My Refund? remains the best way to check the status of a refund.

Some tax returns may be submitted to the IRS for HUB testing before January 29. While acknowledgments may be received during this period, they are not guaranteed. The majority of e-filed tax returns will be queued and transmitted to the IRS when the agency’s E-File system officially opens for all taxpayers on Monday, January 29, 2024.