The 2026 tax season is officially underway, and as happens every year, a small number of early filers are already seeing activity on both Where’s My Refund? and their tax software—even before the IRS opening day.

If you filed early, it’s important to understand what an early “accepted” status really means and what happens next.

Early Filers & Where’s My Refund?

If you completed your tax return ahead of schedule, keep an eye on Where’s My Refund? The IRS is currently in its HUB Testing phase, during which a limited number of returns are accepted each day as part of internal system testing.

If you see an “accepted” message during this period, it means your return passed basic validation checks—not that normal processing has begun.

What Is IRS HUB Testing?

HUB Testing, also known as the IRS Controlled Launch, is the IRS’s annual pre-season testing period. About a week before the official opening of filing season, the IRS works with approved e-file providers to ensure systems, software, and data flows are operating correctly.

During this phase:

- A small number of e-filed returns are randomly selected from queued batches

- Returns receive real acknowledgments or rejections

- Some returns may move into limited processing

- In rare cases, refunds may be issued early

The 2026 IRS Opening Day is Monday, January 26, 2026. HUB Testing takes place prior to that date and is not the same as full filing season.

Can Refunds Be Issued During HUB Testing?

Based on patterns from prior years, some early-filed returns that do NOT claim:

- Earned Income Tax Credit (EITC), or

- Additional Child Tax Credit (ACTC)

may be processed during HUB Testing if the return is complete, accurate, and issue-free.

In limited cases, taxpayers have received refunds in the first weeks of February, though this is not guaranteed and applies to only a small percentage of filers.

How Many Returns Are Included in Test Batches?

In recent filing seasons, the IRS has processed over 140 million individual tax returns, with the majority being electronically filed.

Only a small fraction of early-filed returns—potentially under 10 million—are pulled into HUB Testing batches nationwide. Most early returns are simply held in queue until Opening Day.

Will Being Selected for HUB Testing Get You Your Refund Faster?

It depends.

Returns without EITC or ACTC

- If approved during HUB Testing, refunds may be issued earlier than most

- Earliest possible direct deposit dates typically fall in early February

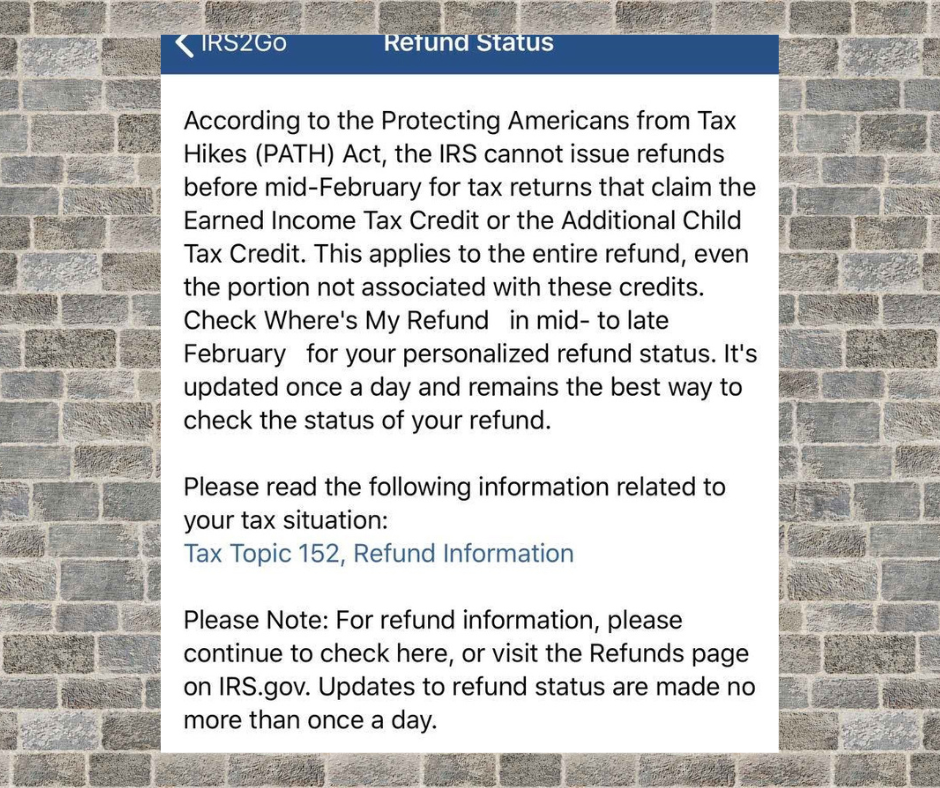

Returns with EITC and/or ACTC

- Even if accepted during HUB Testing, refunds are legally held

- The PATH Act prohibits issuing these refunds before February 15, 2026

PATH Act Refund Holds for 2026

Under the Protecting Americans from Tax Hikes (PATH) Act, the IRS cannot release refunds that include EITC or ACTC until mid-February, regardless of when the return is accepted.

For 2026:

- PATH refunds are held until at least February 15, 2026

- The IRS expects most EITC/ACTC refunds to reach bank accounts in late February, assuming direct deposit and no issues

- Where’s My Refund? is expected to update for most PATH filers around February 21, 2026

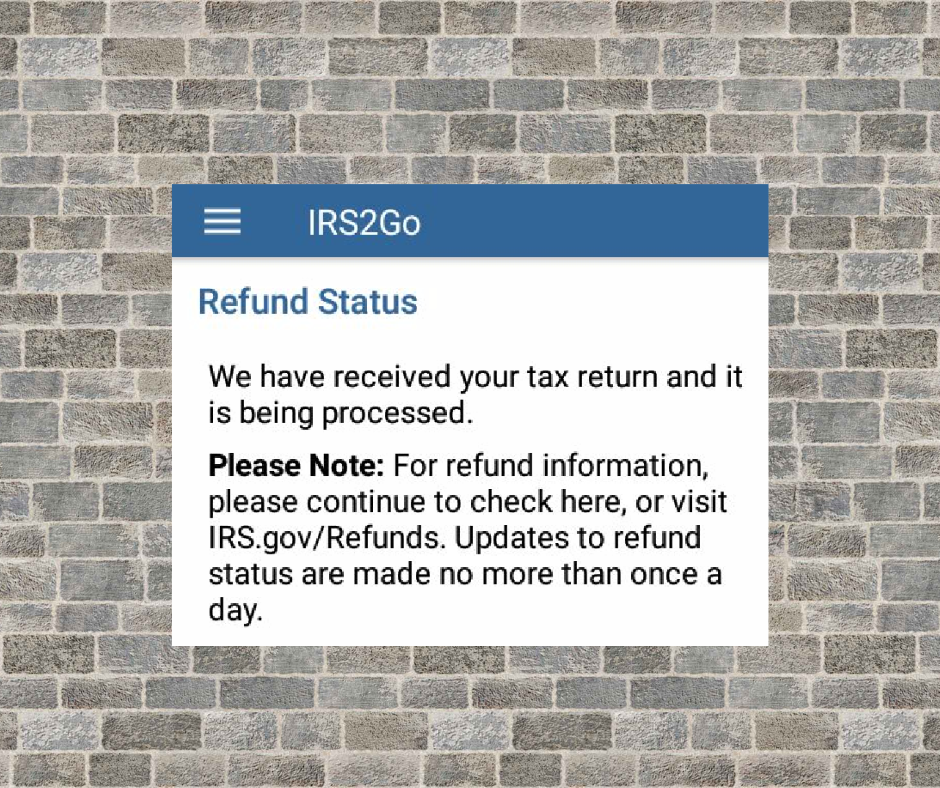

Before that update, taxpayers may see only:

- “Return Received,” or

- “Your return is still being processed”

Refund dates will not appear until PATH releases begin.

Important Timing Notes

- Most refunds are issued within 21 days after processing begins

- Bank posting times can add 1–3 additional days

- Paper checks take longer

- Any review, correction, or missing information can delay a refund

Neither tax software nor preparers receive refund dates before they appear on Where’s My Refund?, making it the most reliable tracking tool.

Reminder for Early Filers

Some tax returns may be submitted during HUB Testing and receive acknowledgments before Opening Day—but this is not guaranteed.

The majority of tax returns will be transmitted and begin full processing when the IRS e-file system officially opens for all taxpayers on Monday, January 26, 2026.

Accepted early does not mean processed early—but understanding the difference can save you a lot of unnecessary stress.