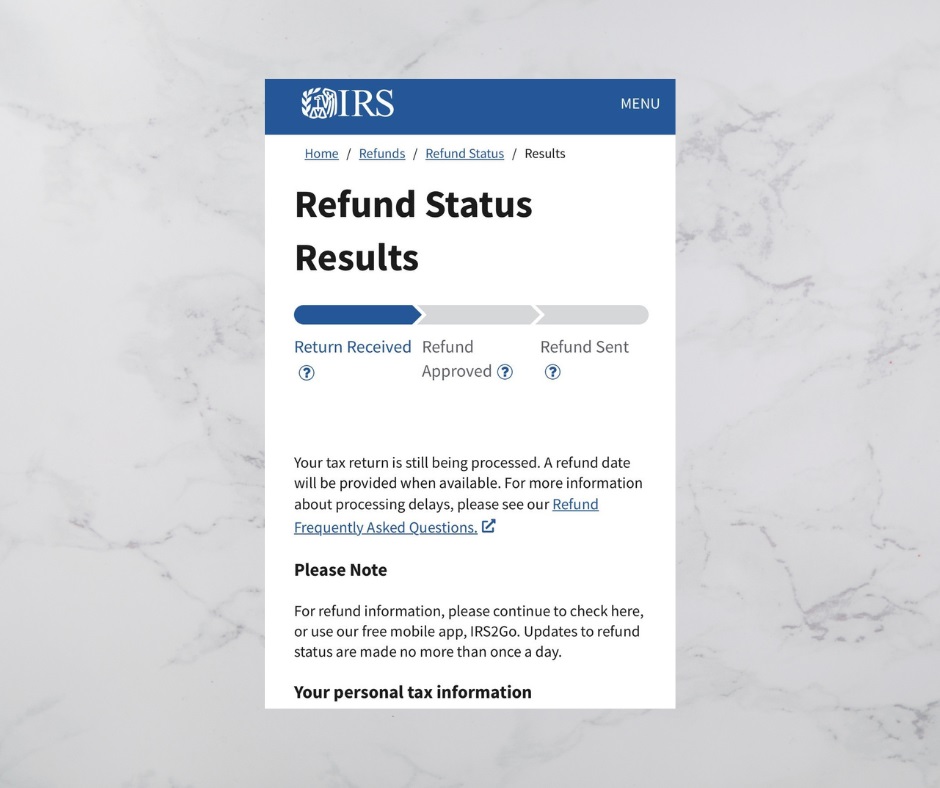

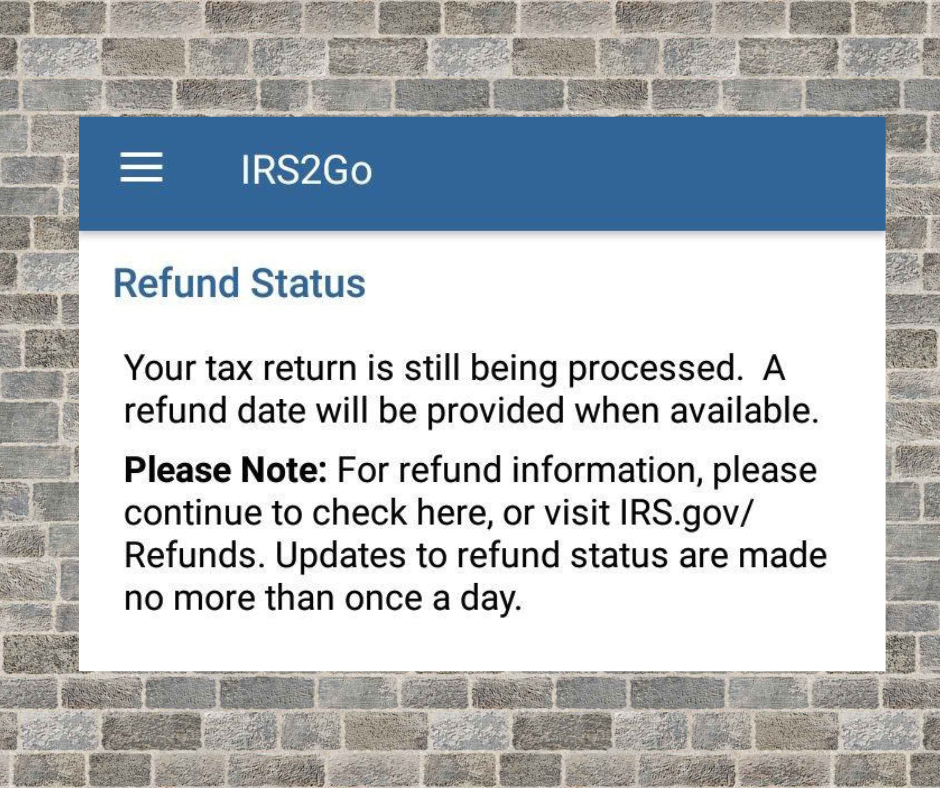

What does “Your tax return is still being processed” mean?

The tax refund status message “your tax return is still being processed” is used by the IRS to inform taxpayers that the IRS is Still Processing their tax return, but the IRS systems may have potentially detected an issue that could possibly delay the tax refund longer than the original 21-day processing timeframe.

Why did my refund status update to “Your tax return is still being processed”?

The “Still Being Processed” tax refund status from the IRS means that your tax return is still under review and has not yet been finalized. This status usually occurs when the IRS has identified an issue with your return that needs further attention, such as missing or conflicting information.

In some cases, the IRS system can resolve the issue automatically without requiring any further action from the taxpayer. However, in other instances, the IRS may need to verify certain details, such as income, dependents, or credits claimed, before they can proceed with finalizing the tax return. While your tax return is paused for verification or correction, the IRS will not issue a refund until the issue is fully resolved.

In most cases, no action is required from you unless the IRS contacts you for more details or documentation. However, this status indicates that processing is taking longer than usual.

What things could trigger the still-being-processed tax refund status?

- Identity Verification

- Errors found on the tax return

- Questionable Refundable Tax Credits

- Wage and Withholding verification

What types of letters could be issued if I have the “still being processed” tax refund status?

- 5216C/5071C – Identity Verification

- 12C– Errors found on tax return

- CP11/CP12 – Math Errors

- 3219C/ 4800C – Questionable Refundable Credits

- CP05A – Wage and Withholding Verification

When your refund status changes and you lose your refund status bars to a “Still Being Processed” message

If you happen to see the refund status as “still being processed”, don’t panic. The IRS is still working to complete your tax return, but processing will be on hold until the IRS corrects the return or sends you a letter requesting more information to complete the processing of the tax return.

This is the procedure the IRS will use to correct the issue:

- Some simple errors like math errors, spelling errors, etc. will be corrected by the IRS and your tax refund status should update to the “being processed” message or a direct deposit date once the issue is corrected.

- In more complex situations like verifying information, identity verification, incomplete or missing forms, and multiple other reasons you could be waiting for a letter to arrive by mail requesting further information. Once you have completed the steps in the letter the IRS will update your account with the corrected information. Once the system acknowledges the adjustments to the account your tax refund status should update to the “being processed” message or a direct deposit date once the issue is corrected.

Remember everybody’s tax obligations are different

The “still being processed” tax refund status can mean different things to different taxpayers. But one thing is for sure, if you see this refund status, chances are the system found some kind of error or incomplete information on your tax return.

What does this mean for my tax return?

Additional information is required to fully process your tax return. Depending on the circumstances, the IRS will send you an explanation or guidance by mail. The IRS still has your return but things are essentially on hold until the IRS gets the additional information from you to continue processing your tax return. You will either get directions on WMR or IRS2Go or the IRS will contact you by mail. Please return any additional information as soon as possible following the instructions provided to obtain a possible refund and minimize any further delay. If you are unsure of the IRS requirements, please consult your accountant, tax advocate, or tax professional.

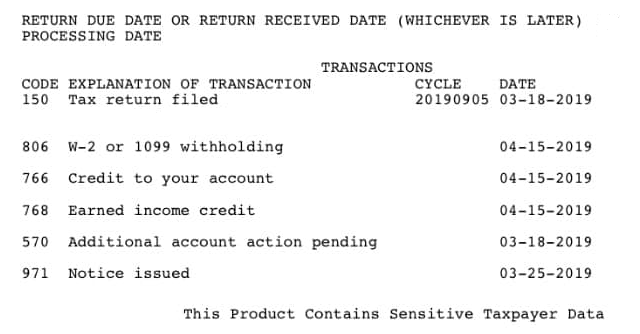

Having online access to your Account Transcripts can help you see what is going on inside your account

If you are stuck on the still being processed message we recommend you try to view your accounttranscripts online. By viewing your account transcript you will be able to follow the explanations of the transaction section of the transcript and view the transaction codes that are showing up on your account and you will also be able to see if you have any notices issued by the IRS.

Get access to your Online account at IRS.GOV

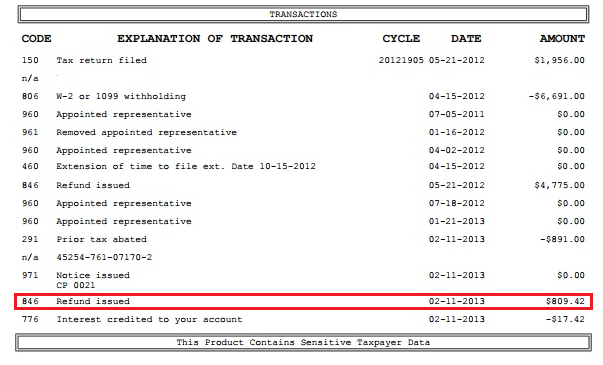

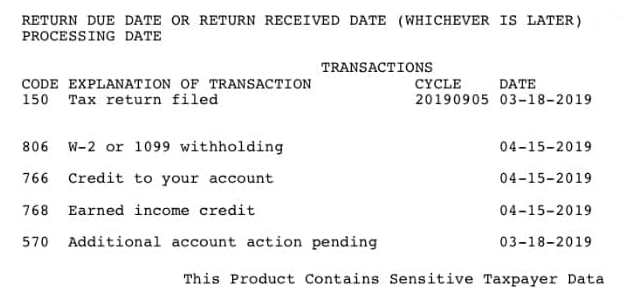

Transcript with the “Still Being Processed” message on WMR

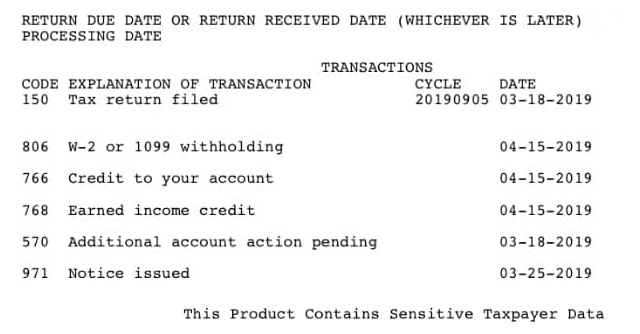

On your Account Transcripts monitor the list of codes under the Explanations of Transactions section at the bottom of the page, if you see a “971 Notice Sent” this could mean the IRS will be mailing you correspondence.

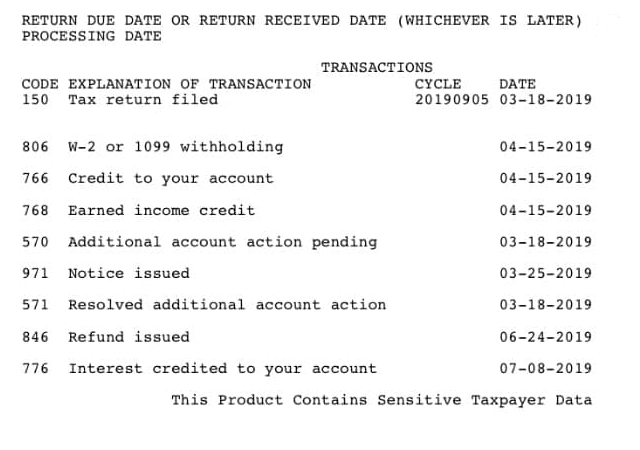

After Identity Verification was completed this is an updated copy of the account transcript

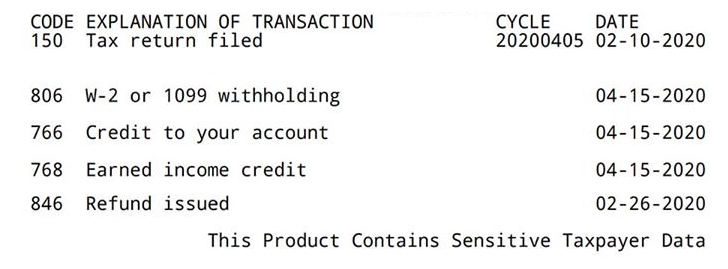

Here is a transcript with the “still being processed” and their account is under further review for 45-60 days.

After the 570 you will see a 571 or 572 posted to the Account Transcript before the 846 Refund Issued code will post to the Account

To Determine a Direct Deposit Date you need an 846 Refund Issued Code on your tax transcript

You will need to watch your tax account transcript frequently and follow the EXPLANATION OF TRANSACTION section on your tax account transcript and wait until you see the846 Refund issuedtransaction code to post on your transcript, indicating that you will be getting a refund and your direct deposit date has already been determined. The date next to the 846 Refund Issued is when the IRS should send your tax refund to your financial institution.