Transaction Codes (TC) consist of three digits. They are used to identify a transaction being processed and to maintain a history of actions posted to a taxpayer’s account on the Master File. Every transaction processed by the IRS must contain a Transaction Code to maintain Accounting Controls of debits and credits, to cause the computer to post the transaction on the Master File, to permit compilation of reports, and to identify the transaction when a transcript is extracted from the Master File.

- Transaction Codes (TC) record specific types of actions (e.g., debits, credits, etc.) onto the accounts/module.

- Some transaction codes indicate action on the Entity Module only, (e.g., TCs 149 or smaller).

- When posted to tax modules, some transaction codes produce neither a debit nor a credit (e.g., TC 570, TC 470). Although this list is not

all inclusive , these transaction codes may:- Prevent credits from refunding

- Prevent credits from offsetting

- Delay subsequent notices and other computer outputs

- Cause information documents to be generated

- Contain item adjustment information

- Set Freeze Conditions

The IRS transaction codes are typically listed on a taxpayers account transcript. The transaction guide identifies many of the most often used codes. You can click here to get your transcripts!

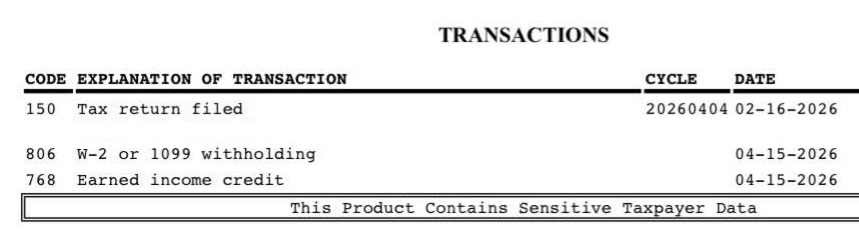

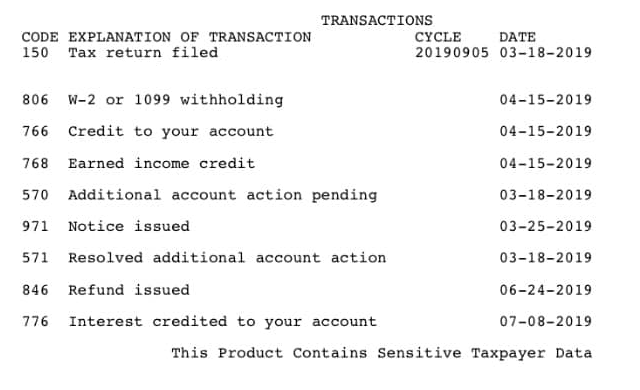

This is an example of an Account Transcript waiting for an 846 code to post after February 15 with PATH ACT message

This account transcript verifies that you have been accepted and are processing and you will not have a confirmation of your status until after February 15th. If more information is needed the IRS will send you a letter or you can view your transcript online to see further codes after February 15th. Until your Explanation of Transaction list shows an 846 Refund Issued code you are not guaranteed your refund on any certain date.

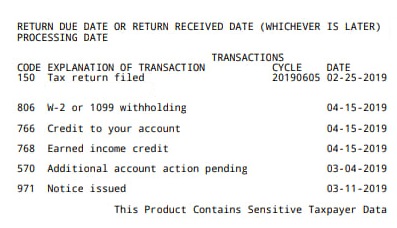

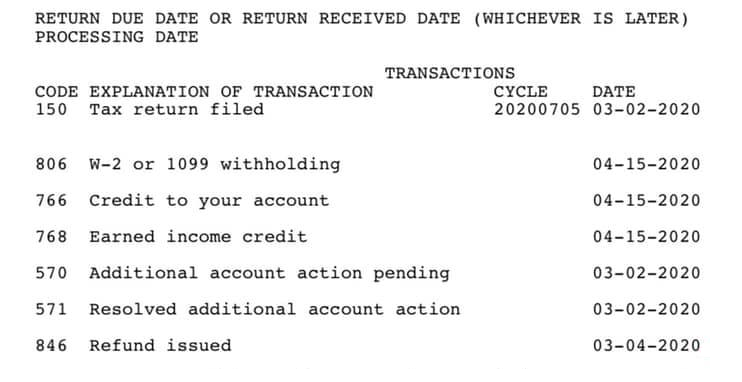

This is an example of an Account Transcript with more codes listed

While the IRS is processing your return the Explanation of Transactions can change at any time. These transactions will keep you updated with what is going on with your tax account more accurately than the Where’s my Refund website or App. If you have certain codes that are held or freezes you can view your transcript online daily for updates. If you have a hold or freeze on your account you will have to wait for a release code to post to the transaction list before you would see an 846 refund issued code.

The Transaction Code 570 Additional Account Action Pending will stop a refund from being issued until the impact of the action being taken on the account and the refund is determined and processed.

If you have a 570 code there is a good chance you may receive a letter explaining any adjustments to your account. If you have a 570 code on your account transcript you will need to wait for a 571 or 572 resolved additional account action code to post which will reverse the 570 code before you would see

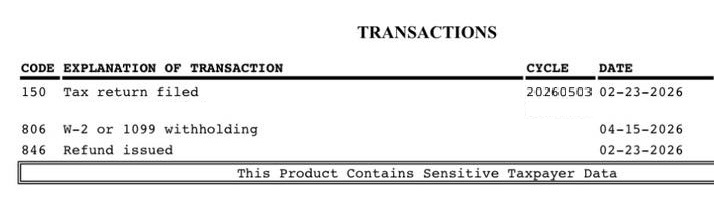

This is an example of a Completed Account Transcript with an 846 Refund Issued Code

If you view your online or mailed transcripts and you see the 846 Refund Issued code under the Explanation of Transactions list. Your return is done processing and you should be receiving a Direct Deposit or Paper Check within 5-10 days.

Common Tax Transcript Codes

- Code 150 Tax Return Filed & Tax Liability Assessed

- Code 570 Additional Liability Pending/or Credit Hold

- Code 766 Reversal of refund applied to non-IRS debt Generated Refundable Credit Allowance or IRS TOP Offset Reversal w/OTN

- Code 766 Tax rebate Generated Refundable Credit Allowance or IRS TOP Offset Reversal w/OTN

- Code 766 Tax relief credit Generated Refundable Credit Allowance or IRS TOP Offset Reversal w/OTN

- Code 767 Reduced or removed credit to your account Generated Reversal of Refundable Credit Allowance or Rejected TOP Offset Reversal w/OTN A generated error correction which reverses a TC

- Code 766 credit allowance posted in error. Results from the appropriate line item adjustment of an Examination or DP Tax Adjustment with item reference 334 (199312-199411 only) for an installment of 1993 additional taxes.

- Code 767 Generated Reversal of Refundable Credit Allowance

- Code 767 w/OTN Reverses a prior posted TC 766, TOP offset reversal when input with the same offset trace number (OTN). Caution: This transaction must not be input except to correct a TC 766 on the FMS Reject Listing.

- Code 768 Earned Income Credit

- Code 810 Refund Freeze

- Code 811 Refund Release

- Code 820 Refund used to offset prior IRS Debt

- Code 836 Refund you chose to apply to next year’s taxes.

- Code 840 Manual Refund

- Code 846 Refund approved

- Code 898 Refund used to offset FMS Debt

Here’s a Full List of All the IRS Transaction Codes

Transaction Codes (TC) consist of three digits. They are used to identify a transaction being processed and to maintain a history of actions posted to a taxpayer’s account on the Master File. Every transaction processed by the IRS must contain a Transaction Code to maintain Accounting Controls of debits and credits, to cause the computer to post the transaction on the Master File, to permit compilation of reports, and to identify the transaction when a transcript is extracted from the Master File. Transaction codes that are unique to IDRS are also included. The definitions of several transaction codes are necessarily changed since there will be no resequencing, offsetting, or computer generated interest. In addition, all refunds will be scheduled manually with the refunds posted to the IMF using TC 846.

The abbreviations used under the heading “File” are as follows:

IRS Transaction Codes 000–998 (Plain-Language Guide)

Use this lookup table to match the TC Code on your IRS transcript with the official IRS description and an easy-to-understand meaning in plain language.

| TC Code | Official IRS Description | Easy-to-Understand Meaning |

|---|---|---|

| 000 | Establish an Account or Plan | Account Created |

| 001 | Resequence an Account due to a TIN Change | Account records were reorganized due to a change in your SSN/EIN. |

| 002 | Resequence EPMF Merge-Fail | Employee Plan record merge failed. |

| 003 | Duplicate Tax Modules are not Resequenced | Duplicate tax records were found but not combined. |

| 004 | BMF Partial Merge | Part of a Business Master File (BMF) account was merged. |

| 005 | Resequenced Account or Plan for Merge | Account was reorganized for merging with another record. |

| 006 | Account Resequenced to Master File Location | Account record was successfully moved/reorganized. |

| 007 | Carrier Transaction | Internal carrier-related transaction (rarely seen). |

| 008 | IMF/BMF Complete Merge | Account Merge Completed. Your tax records were fully combined. |

| 011 | Change EIN or SSN | A change was made to the Taxpayer ID (SSN/EIN) on file. |

| 012 | Reopen Entity Account or Plan | Account was reactivated. |

| 013 | Name Change | Name changed on the account. |

| 014 | Address Change | Address changed on the account. |

| 015 | Location and/or ZIP Code | Location information was updated. |

| 016 | Miscellaneous Change Entity Codes | Minor changes to account status codes. |

| 017 | Spouse SSN | Spouse’s SSN was updated/validated. |

| 018 | Release Undeliverable Refund Check Freeze | Freeze on a non-delivered refund check was removed. |

| 019 | ZIP Code/Area Office Change | Geographic/location data updated. |

| 020 | Closes Account or Deactivates Account or Delete a Plan | Account Closed/Deactivated. |

| 022 | Delete EO Submodule | Tax-exempt organization sub-module deleted. |

| 023 | Reverse the election to lobby | Reversed a decision to report lobbying activities. |

| 024 | Election to Lobby | Election made to report lobbying activities. |

| 025 | No Resequence-SSN | Account reorganization was blocked due to SSN. |

| 026 | Delete Changed TIN or Old Plan Data | Old account data was deleted following a TIN change. |

| 030 | Update Location Codes Out-of-Campus | Updated location codes for an office outside the main processing campus. |

| 040 | Directs Change to Valid SSN | Action to change an incorrect SSN to a valid one. |

| 041 | Directs Change to Invalid SSN | Action to change a valid SSN to an invalid one (usually for reversal/correction). |

| 052 | Reversal of TC 053, 054, 055 | Reversal of a plan or fiscal year change. |

| 053 | Plan Year Ending Month Change | The official plan/fiscal year end month was changed. |

| 054 | Retained FYM | Fiscal Year Month (FYM) was retained. |

| 055 | Change or Adopt New FYM | A new Fiscal Year Month (FYM) was adopted. |

| 057 | Reversal of TC 054, 055 | Reversal of a retained or new Fiscal Year Month. |

| 058 | Rejection of Form 8716 | Request for a fiscal tax year end was rejected. |

| 059 | Rejection of Form 1128 | Request for change in accounting period was rejected. |

| 060 | Elect Foreign Sales Corporation (FSC) | Election to be treated as a Foreign Sales Corporation. |

| 061 | Revoke Reverses TC 060, 063, 064, or 065 | Revocation of an FSC election/status. |

| 062 | Erroneous | Internal transaction error (for correction). |

| 063 | FSC Election Received | Foreign Sales Corporation election request received. |

| 064 | FSC Election Denied | Foreign Sales Corporation election request denied. |

| 065 | FSC Revocation Received | Request to revoke Foreign Sales Corporation status received. |

| 066 | Terminate FSC Received | Request to terminate FSC status received. |

| 070 | Church Exemption from Social Security Taxes | Church was granted an exemption from SS taxes. |

| 071 | Revocation of Church Exemption from Social Security Taxes | Church’s SS tax exemption was revoked. |

| 072 | Deletion of TC 070 Input in Error | Church exemption entry (TC 070) was deleted because it was entered by mistake. |

| 073 | Correction of Erroneous Revocation / Termination | Correction made after a revocation/termination was entered by mistake. |

| 076 | Indicate acceptance of Form 8832 | Entity Classification Accepted. The IRS accepted the entity’s choice of tax classification. |

| 077 | Reversal of TC 076 | Reversal of the accepted entity classification. |

| 078 | Rejection of Form 8832, Entity Classification Election | Request to change tax classification was rejected. |

| 079 | Revocation of Form 8832, Entity Classification Election | Entity classification was revoked. |

| 080 | Validates Spouse’s SSN | Confirmed the spouse’s Social Security Number. |

| 082 | Acceptance of Form 8869 | Qualified Subchapter S Subsidiary (QSub) election accepted. |

| 083 | Reversal of TC 082 | Reversal of QSub election acceptance. |

| 084 | Termination of Form 8869 | QSub election terminated. |

| 085 | Reversal of TC 084 | Reversal of QSub election termination. |

| 086 | Effective date of revocation | Effective date set for a revocation. |

| 087 | Reversal of TC 086 | Reversal of the effective date of revocation. |

| 090 | Small Business Election | Small Business tax election entered. |

| 091 | Terminate Small Business | Small Business tax election terminated. |

| 092 | Reverses TC 090, 093, 095, 097 | Reverses a Small Business election action. |

| 093 | Application for Small Business Election | Application for Small Business status filed. |

| 094 | Application for Small Business Denied | Application for Small Business status denied. |

| 095 | Application for Small Business Pending | Application for Small Business status is awaiting approval. |

| 096 | Small Business Election Terminated | Small Business election status was terminated. |

| 097 | Application for Small Business Pending National Office Approval | Small Business application awaiting approval from the National Office. |

| 098 | Establish or Change in a Fiduciary Relationship | An agent or trustee relationship was established or changed. |

| 099 | Termination of Fiduciary Relationship | The agent or trustee relationship was terminated. |

| 100 | Acceptance of Qualified Subchapter S Trust (QSST) | QSST election accepted. |

| 101 | Revocation of Qualified Subchapter S Trust (QSST) | QSST election revoked. |

| 102 | Acceptance of Electing Small Business Trust (ESBT) | ESBT election accepted. |

| 103 | Revocation of Electing Small Business Trust (ESBT) | ESBT election revoked. |

| 110 | Designates Windfall Profits Tax Return to GMF Unpostable System | Internal marker for Windfall Profits Tax return that couldn’t be posted automatically. |

| 120 | Account Disclosure Code | Internal code for access/disclosure flags on the account. |

| 121 | Employee Plan Characteristics | Information about an Employee Plan was updated. |

| 122 | Reversal of Employee Plan Characteristics | Reversal of Employee Plan update. |

| 123 | Update of Employee Plan Characteristics | Update of Employee Plan information. |

| 125 | Plan Termination | Employee Plan terminated. |

| 126 | Reversal of Termination | Reversal of the Employee Plan termination. |

| 127 | Administrator Data Change | Administrator information for the plan was changed. |

| 128 | Administrator Data Change | Administrator information for the plan was changed. |

| 129 | HHS Request | Internal code related to a Health and Human Services request. |

| 130 | Entire Account Frozen from Refunding | REFUND HOLD: Your entire account is frozen, and a refund cannot be issued yet. |

| 131 | Reversal of TC 130 Refund Freeze | The refund hold (TC 130) has been lifted. |

| 132 | Reversed TC 130 | The refund hold (TC 130) was reversed. |

| 136 | Suppress FTD Alert | Internal action to stop Federal Tax Deposit (FTD) alerts. |

| 137 | Reverse Suppress | Reversal of an internal suppression action. |

| 140 | IRP Delinquency Inquiry | Inquiry regarding Information Return Processing (IRP) delinquency. |

| 141 | Delinquency Inquiry | Internal inquiry started because a return is missing or late. |

| 142 | Delinquency Investigation | Formal investigation started for a missing or late return. |

| 148 | Issuance of TDA or Assembly | Collection Action Started: Internal code signaling the start of a Taxpayer Delinquency Account (TDA) or case assembly. |

| 149 | Reversal of TC 148 | Reversal of the collection action start. |

| 150 | Return Filed & Tax Liability Assessed | RETURN PROCESSED / TAX BASELINE: The IRS posted your return and established your initial tax amount due or refund. |

| 151 | Reversal of TC 150 or 154 | Reversal of the original tax assessment (TC 150) or F5330 posting. |

| 152 | Entity Updated by TC 150 | Account entity data was updated during the TC 150 return process. |

| 154 | Posting F5330 Data | Posting of tax data from Form 5330 (excise taxes). |

| 155 | 1st Correspondence Letter Sent | First letter of official communication sent. |

| 156 | Subsequent Correspondence Sent | A follow-up letter or notice was sent. |

| 157 | Schedule A / Form 5578, Non- Discrimination Certification | Internal posting of Schedule A data or non-discrimination certificate. |

| 159 | Settlement Data | Internal code related to settlement information. |

| 160 | Manually Computed Delinquency Penalty | A late-filing penalty was manually calculated and applied. |

| 161 | Abatement of Delinquency Penalty | The late-filing penalty was removed or reduced. |

| 162 | Failure to File Penalty Restriction Deletion | Restriction on the late-filing penalty was removed. |

| 166 | Delinquency Penalty | Late Filing Penalty Assessed. Penalty charged for filing the tax return after the deadline. |

| 167 | Abate Delinquency Penalty | The late-filing penalty was removed or reduced. |

| 170 | Estimated Tax Penalty | Estimated tax penalty manually assessed. |

| 171 | Abatement of Estimated Tax Penalty | Estimated tax penalty was removed or reduced. |

| 176 | Estimated Tax Penalty | Estimated Tax Penalty Assessed. Penalty charged for failing to pay estimated taxes correctly. |

| 177 | Abatement of Estimated Tax Penalty | Estimated tax penalty was removed or reduced. |

| 180 | Deposit Penalty | Penalty assessed for late/incorrect tax deposits. |

| 181 | Deposit Penalty Abatement | Deposit penalty was removed or reduced. |

| 186 | FTD (Deposit) Penalty Assessment | Penalty for failure to deposit Federal Taxes (FTD) correctly. |

| 187 | Abatement of FTD Penalty Assessment | FTD penalty was removed or reduced. |

| 190 | Manually Assessed Interest Transferred In | Interest manually calculated and transferred to this module. |

| 191 | Interest Abatement | Interest charge was removed or reduced. |

| 196 | Interest Assessed | Interest Charged. Interest was calculated and applied to an unpaid tax balance. |

| 197 | Abatement of Interest Assessed | The interest charge was removed or reduced. |

| 200 | Taxpayer Identification Number Penalty Assessment | Penalty assessed for incorrect or missing SSN/EIN. |

| 201 | Taxpayer Identification Number Penalty Abatement | SSN/EIN penalty was removed or reduced. |

| 234 | Assessed Daily Delinquency Penalty | Penalty for delinquency calculated daily was assessed. |

| 235 | Abates Daily Delinquency Penalty | Daily delinquency penalty was removed or reduced. |

| 238 | Daily Delinquency Penalty | Penalty for delinquency calculated daily was assessed. |

| 239 | Abatement of Daily Delinquency Penalty | Daily delinquency penalty was removed or reduced. |

| 240 | Miscellaneous Penalty | An unspecified penalty was assessed. |

| 241 | Abate Miscellaneous Civil Penalty | The unspecified civil penalty was removed or reduced. |

| 246 | Form 8752 or 1065 Penalty | Penalty related to an S-Corp/Partnership tax year election. |

| 247 | Abatement of 1065 Penalty | Partnership tax penalty was removed or reduced. |

| 270 | Manual Assessment Failure to Pay Tax Penalty | Failure-to-Pay penalty manually assessed. |

| 271 | Manual Abatement of Failure to Pay Tax Penalty | Failure-to-Pay penalty manually removed. |

| 272 | Failure to Pay Penalty Restriction Deletion | Restriction on the Failure-to-Pay penalty was removed. |

| 276 | Failure to Pay Tax Penalty | Failure to Pay Penalty Assessed. Penalty charged for not paying the tax liability on time. |

| 277 | Abatement of Failure to Pay Tax Penalty | The failure-to-pay penalty was removed or reduced. |

| 280 | Bad Check Penalty | Bad check penalty manually assessed. |

| 281 | Abatement of Bad Check Penalty | Bad check penalty was removed or reduced. |

| 286 | Bad Check Penalty | Bad Check Penalty Assessed. Penalty charged because a payment you made was dishonored by the bank. |

| 287 | Reversal of Bad Check Penalty | The bad check penalty was reversed. |

| 290 | Additional Tax Assessment | Tax Increase (Basic). The IRS determined you owe more tax due to a correction or audit. |

| 291 | Abatement Prior Tax Assessment | Tax Decrease (Basic). The IRS reduced or reversed a previous tax amount (may result in a refund). |

| 294 | Additional Tax Assessment with Interest Computation Date | Tax increase (TC 290) with a specific date used to calculate interest. |

| 295 | Abatement of Prior Tax Assessment with Interest Computation Date | Tax decrease (TC 291) with a specific date used to calculate interest. |

| 298 | Additional Tax Assessment with Interest Computation Date | Tax increase (TC 290) with a specific date used to calculate interest. |

| 299 | Abatement of Prior Tax Assessment Interest Computation Date | Tax decrease (TC 291) with a specific date used to calculate interest. |

| 300 | Additional Tax or Deficiency Assessment by Examination Div. or Collection Div. | Audit/Collection Tax Increase. Additional tax resulting from an audit or collection action. |

| 301 | Abatement of Tax by Examination or Collection Div. | Audit/Collection Tax Decrease. Tax amount reduced following an audit or collection action. |

| 304 | Additional Tax or Deficiency, Assessment by Examination, Div. with Interest Computation Date | Tax increase (TC 300) with a specific date used to calculate interest. |

| 305 | Abatement of Prior Tax Assessment by Examination Div. with Interest Computation Date | Tax decrease (TC 301) with a specific date used to calculate interest. |

| 308 | Additional Tax or Deficiency Assessment by Examination or Collection Div. with Interest Computation Date | Tax increase (TC 300) with a specific date used to calculate interest. |

| 309 | Abatement of Prior Tax Assessment by Examination Div. with Interest Computation date | Tax decrease (TC 301) with a specific date used to calculate interest. |

| 310 | Penalty for Failure to Report Income from Tips | Penalty assessed for underreporting tip income. |

| 311 | Tip Penalty Abatement | Tip penalty was removed or reduced. |

| 320 | Fraud Penalty | Penalty assessed due to fraud. |

| 321 | Abatement of Fraud Penalty | Fraud penalty was removed or reduced. |

| 336 | Interest Assessment on Additional Tax or Deficiency | Interest charged on the amount from a tax increase (TC 290/300). |

| 337 | Abatement of Interest Assessed on Additional Tax or Deficiency | Interest charged on a tax increase was removed or reduced. |

| 340 | Restricted Interest Assessment | Interest charge applied with certain limitations/restrictions. |

| 341 | Restricted Interest Abatement | Restricted interest charge was removed or reduced. |

| 342 | Interest Restriction Deletion | Limitation on interest calculation was removed. |

| 350 | Negligence Penalty | Penalty assessed for negligence. |

| 351 | Negligence Penalty Abatement | Negligence penalty was removed or reduced. |

| 360 | Fees & Collection Costs | Fees and costs related to collection actions were assessed. |

| 361 | Abatement of Fees & Collection Costs | Collection fees and costs were removed or reduced. |

| 370 | Account Transfer-In | Tax Balance Received. A balance (tax, penalty, or interest) was moved into this account from another module. |

| 380 | Overpayment Cleared Manually | An overpayment was manually cleared. |

| 386 | Clearance of Overpayment | An overpayment was cleared from the module. |

| 388 | Statute Expiration Clearance to Zero Balance and Removal | An old balance was cleared to zero because the collection statute of limitations expired. |

| 389 | Reversal of Statute Expiration | Reversal of a statute expiration clearance. |

| 400 | Account Transfer-out | Tax Balance Moved. A balance was moved out of this account to another module. |

| 402 | Account Re-Transferred-In | Balance was moved back into this account. |

| 420 | Examination Indicator | Under Audit/Review. Your account is now flagged for or currently undergoing an audit or examination. |

| 421 | Reverse Examination Indicator | The audit/review flag (TC 420) was reversed or removed. |

| 424 | Examination Request Indicator | Internal request for an examination was logged. |

| 425 | Reversed TC 424 | Reversal of the examination request. |

| 427 | Request Returns from SERFE file | Request for returns from an internal archive file. |

| 428 | Examination or Appeals Case Transfer | The audit or appeals case was transferred to another office. |

| 429 | Request AIMS Update from MF | Request for audit data update from the master file. |

| 430 | Estimated Tax Declaration | Estimated tax declaration was posted. |

| 446 | Merged Transaction Indicator | Internal code indicating transactions were merged. |

| 450 | Transferee Liability Assessment | Tax assessed against you for the liability of another person or entity. |

| 451 | Reversal of TC 450 | Reversal of the transferee liability assessment. |

| 459 | Prior Quarter Liability, Forms 941 and 720 | Prior quarter tax liability posted (e.g., employment or excise tax). |

| 460 | Extension of Time for Filing | Filing Extension Granted. You were granted an extension to file your return. |

| 462 | Correction of a TC 460 Transaction Processed in Error | Correction of an erroneous extension posting. |

| 463 | Waiver to File on Mag Tape | Waiver granted to file returns using magnetic media (e.g., tapes). |

| 464 | Reversal of TC 463 | Reversal of the magnetic media filing waiver. |

| 468 | Extension of Time to Pay Estate Tax | Extension granted to pay Estate Tax. |

| 469 | Reversal of TC 468 | Reversal of the Estate Tax payment extension. |

| 470 | Taxpayer Claim Pending | Claim/Appeal Pending. A hold is placed because you filed a claim (like an amended return or appeal) that is being reviewed. |

| 471 | Reversal of Taxpayer Claim Pending | The claim/appeal hold (TC 470) was removed or reversed. |

| 472 | Reversal of Taxpayer Claim Pending | The claim/appeal hold (TC 470) was removed or reversed. |

| 474 | Interrupts Normal Delinquency Processings | Temporarily stops automatic delinquency notices. |

| 475 | Permits TDI Issuance | Allows the issuance of a Taxpayer Delinquency Investigation (TDI). |

| 480 | Offer-in-Compromise Pending | Offer in Compromise (OIC) Filed. Your request to settle your debt for less than the full amount is pending. |

| 481 | Offer-in-Compromise Rejected | Your Offer in Compromise was rejected. |

| 482 | Offer-in-Compromise Withdrawn/Terminated | Your Offer in Compromise was withdrawn or terminated. |

| 483 | Correction of Erroneous Posting of TC 480 | Correction of a mistake in logging the OIC pending status. |

| 488 | Installment and/or Manual Billing | An installment agreement was set up, or manual billing started. |

| 489 | Installment Defaulted | The installment agreement was broken (defaulted). |

| 490 | Mag Media Waiver | Waiver granted for magnetic media filing. |

| 494 | Notice of Deficiency | Formal notice sent stating the IRS calculated a tax deficiency. |

| 495 | Closure of TC 494 or correction of TC 494 processed in error | The Notice of Deficiency case was closed or corrected. |

| 500 | Military Deferment | Military service deferment status applied to the account. |

| 502 | Correction of TC 500 Processed in Error | Correction of an erroneous military deferment posting. |

| 503 | TC 500 changed to 503 when posting TC 502 | Internal change related to the military deferment correction. |

| 510 | Releases Invalid SSN Freeze on Refunds | Refund freeze related to an invalid SSN was removed. |

| 520 | IRS Litigation Instituted | Formal legal action (litigation) was started by the IRS. |

| 521 | Reversal of TC 520 | Reversal of the litigation indicator. |

| 522 | Correction of TC 520 Processed in Error | Correction of an erroneous litigation posting. |

| 524 | Collateral Agreement Pending | A related collateral agreement is pending. |

| 525 | Collateral Agreement No Longer Pending | The collateral agreement is no longer pending. |

| 528 | Terminate Stay of Collection Status | The action that temporarily stopped collection efforts has ended. |

| 530 | Currently not Collectible Account | Debt Stopped (CNC). The IRS has agreed to temporarily stop trying to collect a debt due to your financial hardship. |

| 531 | Reversal of a Currently not Collectible Account | The CNC status (TC 530) was reversed. |

| 532 | Correction of TC 530 Processed in Error | Correction of an erroneous CNC posting. |

| 534 | Expired Balance Write-off, accrued or assessed | An uncollectible debt was cleared from the account because the collection statute expired. |

| 535 | Reversal of Expired Balance Write-off | Reversal of the balance write-off. |

| 537 | Reversal of Currently not Collectible Account Status | The CNC status (TC 530) was reversed. |

| 538 | Trust Fund Recovery Penalty Cases | Case related to the Trust Fund Recovery Penalty (TFRP) started. |

| 539 | Trust Fund Recovery Penalty Case Reversal | TFRP case action was reversed. |

| 540 | Deceased Taxpayer | Status updated for a deceased taxpayer. |

| 542 | Correction to TC 540 Processed in Error | Correction of an erroneous deceased taxpayer status. |

| 550 | Waiver Extension of Date Collection Statute Expires | The time limit for the IRS to collect tax debt was formally extended. |

| 560 | Waiver Extension of Date Assessment Statute Expires | The time limit for the IRS to assess additional tax was formally extended. |

| 570 | Additional Liability Pending/or Credit Hold | REFUND/CREDIT HOLD. A major hold is in place, often due to an audit, income mismatch, or credit verification. Your refund/credits are paused. |

| 571 | Reversal of TC 570 | Hold Released. The hold (TC 570) has been lifted, allowing your account to move forward (often to refund/payment). |

| 572 | Correction of TC 570 Processed in Error | Correction of an erroneous TC 570 posting. |

| 576 | Unallowable Tax Hold | Hold placed because a claimed tax/credit is not allowed. |

| 577 | Reversal Of TC 576 | The unallowable tax hold was reversed. |

| 582 | Lien Indicator | Lien Flagged. A Federal Tax Lien has been filed or is active. |

| 583 | Reverse Lien Indicator | The tax lien flag was removed. |

| 586 | Transfer/revenue receipt cross ref. TIN | Internal transaction for cross-referencing Taxpayer ID information. |

| 590 | Satisfying Trans. Not liable this Tax period | Internal transaction indicating the taxpayer is not liable for this tax period. |

| 591 | Satisfying Trans. No longer liable for tax for same MFT if not already delinquent | Internal transaction indicating the taxpayer is no longer liable for this type of tax. |

| 592 | Reverse 59X Trans. | Reversal of a “Satisfying Transaction” (59X code). |

| 593 | Satisfying Trans. Unable to locate taxpayer | Internal transaction indicating the taxpayer could not be located. |

| 594 | Satisfying Trans. Return previously filed | Internal transaction indicating the return was already filed. |

| 595 | Satisfying Trans. Referred to Examination | Internal transaction indicating the account was referred to Examination (Audit). |

| 597 | Satisfying Trans. Surveyed satisfies this module only | Internal transaction: Case was closed based on review. |

| 598 | Satisfying Trans. Shelved- satisfies this module only | Internal transaction: Case was temporarily halted or set aside. |

| 599 | Satisfying Trans. Returned secured-satisfies this module only | Internal transaction: Necessary return information was secured. |

| 600 | Underpayment Cleared Manually | Tax liability was cleared manually (e.g., through payment application). |

| 604 | Assessed Debit Cleared | An assessed debit (amount owed) was cleared. |

| 605 | Generated Reversal of TC 604 | Reversal of the assessed debit clearance. |

| 606 | Underpayment Cleared | Tax liability was cleared (e.g., by payment). |

| 607 | Reversal of Underpayment Cleared | Reversal of the tax liability clearance. |

| 608 | Statute Expiration Clearance to Zero Balance and Remove | Debt cleared to zero because the collection statute expired. |

| 609 | Reversal of Statute Expiration | Reversal of the debt clearance due to statute expiration. |

| 610 | Remittance with Return | Payment with Filing. Payment made when you originally filed your tax return. |

| 611 | Remittance with Return Dishonored | The payment made with the return (TC 610) was rejected by the bank (bounced check). |

| 612 | Correction of 610 Processed in Error | Correction of an erroneous TC 610 posting. |

| 620 | Initial Installment Payment: Form 7004, MFT 02+33 | Initial installment payment posted (often related to filing extensions). |

| 621 | Installment Payment Check Dishonored | An installment payment check was rejected by the bank. |

| 622 | Correction of TC 620 Processed in Error | Correction of an erroneous installment payment posting. |

| 630 | Manual Application of Appropriation Money | Manual posting of appropriated funds as payment. |

| 632 | Reversal of Manual Application of Appropriation Money | Reversal of the manual fund application. |

| 636 | Separate Appropriations Refundable Credit | Refundable credit from a separate government appropriation. |

| 637 | Reversal of Separate, Appropriations Refundable Credit | Reversal of the appropriation refundable credit. |

| 640 | Advance Payment of Determined Deficiency or Underreporter Proposal | Advance Payment. Payment made toward an anticipated or proposed tax deficiency. |

| 641 | Dishonored Check on Advance Payment | The advance payment check was rejected by the bank. |

| 642 | Correction of TC 640 Processed in Error | Correction of an erroneous advance payment posting. |

| 650 | Federal Tax Deposit | Tax deposit made by a business. |

| 651 | Dishonored Federal Tax Deposit | Business tax deposit was rejected by the bank. |

| 652 | Correction of FTD Posted in Error | Correction of an erroneous FTD posting. |

| 660 | Estimated Tax / Federal Tax Deposit | Estimated Tax Payment. A payment made for quarterly estimated taxes. |

| 661 | ES payment or FTD Check Dishonored | Estimated tax payment check was rejected by the bank. |

| 662 | Correction of TC 660 Processed in Error | Correction of an erroneous estimated tax payment posting. |

| 666 | Estimated Tax Credit Transfer In | Estimated tax credit moved into this account. |

| 667 | Estimated Tax Debit Transfer out | Estimated tax debit moved out of this account. |

| 670 | Subsequent Payment | Later Payment. Any payment made after the original return filing. |

| 671 | Subsequent Payment Check Dishonored | Subsequent payment check was rejected by the bank. |

| 672 | Correction of TC 670 Processed in Error | Correction of an erroneous subsequent payment posting. |

| 673 | Input of a TC 672 Changes an existing TC 670 to TC 673 | Internal code reflecting a correction of a subsequent payment. |

| 678 | Credits for Treasury Bonds | Credit posted from redeemed Treasury bonds. |

| 679 | Reversal of Credits for Treasury Bonds | Reversal of the Treasury bond credit. |

| 680 | Designated Payment of Interest | Payment specified by the taxpayer to cover only interest. |

| 681 | Designated Payment Check Dishonored | Designated interest payment check was rejected by the bank. |

| 682 | Correction of TC 680 Processed in Error | Correction of an erroneous designated interest payment posting. |

| 690 | Designated Payment of Penalty | Payment specified by the taxpayer to cover only a penalty. |

| 691 | Designated Payment Check Dishonored | Designated penalty payment check was rejected by the bank. |

| 692 | Correction of TC 690 Processed in Error | Correction of an erroneous designated penalty payment posting. |

| 694 | Designated Payment of Fees and Collection Costs | Payment specified by the taxpayer to cover only fees and collection costs. |

| 695 | Reverse Designated Payment | Reversal of a taxpayer’s instruction to designate a payment. |

| 700 | Credit Applied | An overpayment was applied to this tax account. |

| 701 | Reverse Generated Overpayment Credit Applied | Reversal of an automatically applied overpayment credit. |

| 702 | Correction of Erroneously Applied Credit | Correction of an overpayment credit that was applied by mistake. |

| 706 | Generated Overpayment Applied from Another Tax Module | Overpayment automatically transferred from a different tax record to this one. |

| 710 | Overpayment Credit Applied from Prior Tax Period | Prior Year Credit. Overpayment from a previous tax year was applied to this year’s tax. |

| 712 | Correction of TC 710 or 716 Processed in Error | Correction of an erroneous prior period credit application. |

| 716 | Generated Overpayment Credit Applied from Prior Tax Period | Overpayment from a previous tax year was automatically applied to this one. |

| 720 | Refund Repayment | Repayment of a refund that was incorrectly issued to you. |

| 721 | Refund Repayment Check Dishonored | The check you used to repay the refund was rejected by the bank. |

| 722 | Correction of TC 720 Processed in Error | Correction of an erroneous refund repayment posting. |

| 730 | Overpayment Interest Applied | Interest paid on a prior overpayment was applied to this account. |

| 731 | Reverse Generated Overpayment Interest Applied | Reversal of the automatically applied overpayment interest. |

| 732 | Correction of TC 730 Processed in Error | Correction of an erroneous overpayment interest application. |

| 736 | Generated Interest Overpayment Applied | Interest calculated on an overpayment was automatically applied. |

| 740 | Undelivered Refund Check Redeposited | A refund check that couldn’t be delivered was redeposited back into your account. |

| 742 | Correction of TC 740 Processed in Error | Correction of an erroneous redeposit. |

| 756 | Interest on Overpayment Transferred from IMF | Interest on an overpayment was transferred from the Individual Master File (IMF). |

| 760 | Substantiated Credit Payment Allowance | A payment or credit was confirmed and formally allowed. |

| 762 | Correction of TC 760 Processed In Error | Correction of an erroneous credit allowance. |

| 764 | Earned Income Credit | Earned Income Tax Credit (EITC) was calculated and posted. |

| 765 | Earned Income Credit Reversal | The EITC amount was reduced or removed. |

| 766 | Generated Refundable Credit Allowance | CREDIT POSTED. Refundable credits (like EITC or Child Tax Credit) were calculated and posted to your account. |

| 767 | Generated Reversal of Refundable Credit Allowance | CREDIT REDUCED. A previously posted refundable credit was reduced or removed. |

| 768 | Earned Income Credit | Earned Income Tax Credit (EITC) was calculated and posted. |

| 771 | Interest Reversal Prior to Refund Issuance | Interest that was due to you was reversed before the refund was sent. |

| 772 | Correction of TC 770 Processed in Error or interest netting | Correction of an erroneous interest calculation or internal interest balancing. |

| 776 | Generated Interest Due on Overpayment | Interest Due to You. Interest was calculated and posted on your overpayment (often right before a refund is issued). |

| 777 | Reverse Generated Interest Due Taxpayer or interest netting | Reversal of the interest due to you. |

| 780 | Master File Account Compromised | Account status changed to compromised (part of OIC process). |

| 781 | Defaulted Account Compromise | The compromise agreement was broken (defaulted). |

| 782 | Correction of TC 780 Processed in Error | Correction of an erroneous compromise posting. |

| 788 | All Collateral Conditions of the Offer Completed | All terms of the Offer in Compromise agreement have been met. |

| 790 | Manual Overpayment Applied from IMF | Overpayment manually transferred from an individual tax record. |

| 792 | Correction of TC 790 Processed in Error | Correction of an erroneous manual overpayment transfer. |

| 796 | Overpayment Credit from IMF | Overpayment credit transferred from an individual tax record. |

| 800 | Credit for Withheld Taxes | Credit posted for taxes withheld from income (W-2, 1099). |

| 802 | Correction of a TC 800 Processed in error | Correction of an erroneous withholding credit. |

| 806 | Credit for Withheld Taxes & Excess FICA | Withholding Credit. Credit posted for taxes withheld from wages (W-2) and excess FICA. |

| 807 | Reversed Credit for Withheld Taxes | Withholding credit was reversed or removed. |

| 810 | Refund Freeze | Temporary internal freeze on the refund portion of the account. |

| 811 | Reverse Refund Freeze | The internal refund freeze was removed. |

| 820 | Credit Transferred | Credit balance was transferred out of this module. |

| 821 | Reverse Generated Overpayment Credit Transferred | Reversal of an automatically transferred credit. |

| 822 | Correction of an Overpayment Transferred In Error | Correction of an overpayment that was transferred out by mistake. |

| 824 | Overpayment Credits Transferred to Another or to Non-MF Accounts | Credit transferred to another tax record or external account. |

| 826 | Overpayment Transferred | Overpayment balance transferred out. |

| 830 | Overpayment Credit Elect (Transferred) to Next Periods Tax | You chose to have this year’s overpayment applied as a payment for next year’s tax. |

| 832 | Correction of Credit Elect | Correction of an erroneous credit election. |

| 836 | Overpayment Credit Elect Transferred to Next Periods Tax | Overpayment was automatically applied to next year’s tax liability. |

| 840 | Manual Refund | A refund was issued through a non-automated (manual) process. |

| 841 | Cancelled Refund Check Deposited | Refund Canceled. A previously issued refund check was canceled and the money returned to your account. |

| 842 | Refund Deletion | The refund action was deleted. |

| 843 | Check Cancellation Reversal | Reversal of a refund check cancellation. |

| 844 | Erroneous Refund | The IRS determined a refund was issued by mistake. |

| 845 | Reverse Erroneous Refund | Reversal of the erroneous refund posting. |

| 846 | Refund of Overpayment Approved | REFUND ISSUED! Your refund has been approved and sent to the Treasury Department. The date on this line is your refund date. |

| 850 | Overpayment Interest Transfer | Interest on an overpayment was transferred out. |

| 851 | Reverse Generated Overpayment Interest Transfer | Reversal of an automatically transferred interest amount. |

| 852 | Correction of TC 850 Processed in Error | Correction of an erroneous interest transfer. |

| 856 | Overpayment Interest Transfer by Computer | Interest on an overpayment was automatically transferred out. |

| 860 | Reverses Erroneous Abatement | Reversal of an abatement (tax decrease) that was done by mistake. |

| 876 | Interest on Overpayment Transferred to BMF | Overpayment interest transferred to a business tax record. |

| 890 | Manual Transfer of Overpayment Credits to BMF | Overpayment credit manually transferred to a business tax record. |

| 892 | Correction of TC 890 Processed in Error | Correction of an erroneous manual credit transfer. |

| 896 | Overpayment Credit Offset | Overpayment credit was used (offset) against another balance due. |

| 897 | DMF Offset Reversal | Reversal of an offset applied by the Debt Management Facility. |

| 898 | FMS TOP Offset | REFUND OFFSET. All or part of your refund was taken to pay a legally enforceable debt (e.g., child support, student loans) through the Treasury Offset Program (TOP). |

| 899 | FMS TOP Offset reversal or Agency Refund/Reversal | Reversal of a TOP offset or an action by the external agency. |

| 901 | Delete IDRS Indicator | Internal IRS database indicator was removed. |

| 902 | Campus IDRS Indicator | Internal IRS database indicator was added. |

| 903 | Master File IDRS Entity Delete | Internal IRS database entity record was deleted. |

| 904 | Notify IDRS Entity or Module not Present | Internal notification that a required record is missing. |

| 920 | IDRS Notice Status | Internal notice status updated. |

| 922 | IRP Underreporter | Internal code for Information Return Processing (IRP) related to underreported income. |

| 924 | IRP Communication | Internal code for IRP communication. |

| 930 | Return Required Suspense | Account put on hold because a return is required but hasn’t been filed. |

| 932 | Reverse Return Required Suspense | The return required hold was removed. |

| 960 | Add/Update Centralized Authorization File Indicator Reporting Agents File | Added or updated the flag for third-party representation (e.g., CPA, tax preparer). |

| 961 | Reverse Centralized Authorization File Indicator | The third-party representation flag was removed. |

| 970 | F720 Additional Schedules; or F945 liability amounts from F945-A and related dates, F941 liability amounts from Schedule B and related dates | Internal posting of liability details from complex business forms. |

| 971 | Miscellaneous Transaction | NOTICE SENT. The IRS has issued a letter or notice concerning your account (often accompanied by TC 570). Check the date for the expected arrival. |

| 972 | Reverses Amended/ Duplicate Return XREF TIN/ Tax Period Data | Reversal of cross-reference data for an amended or duplicate return. |

| 973 | Application for Tentative Refund F1139 Processed Return Filed-8038 Series Return and Additional Filing of Form 5330 | Application for a quick refund (tentative) was processed. |

| 976 | Posted Duplicate Return | The IRS processed a duplicate tax return you filed. |

| 977 | Posted Amended Return Posted Consolidated Generated Amended, Late Reply, or DOL Referral | AMENDED RETURN PROCESSED. Your amended return (Form 1040-X, etc.) has been fully processed. |

| 980 | W-3/1096 Transaction | Transaction related to summary wage/information forms. |

| 982 | CAWR Control DLN Transaction | Internal control code for Compliance Adjustment Wage Report (CAWR). |

| 984 | CAWR Adjustment Transaction | Adjustment made following a CAWR review. |

| 986 | CAWR Status Transaction | Status update for a CAWR review. |

| 990 | Specific Transcript | Internal code indicating a specific type of transcript was generated. |

| 991 | Open Module Transcript | Internal code indicating a transcript of an open tax record was generated. |

| 992 | Complete or TaxClass Transcript | Internal code indicating a complete transcript was generated. |

| 993 | Entity Transcript | Internal code indicating an entity-level transcript was generated. |

| 994 | Two Accounts Failed to Merge/ Transcript Generated | Two account records failed to merge; a transcript was created to review. |

| 995 | Difference in Validity Status/ Transcript Generated | A discrepancy in SSN/EIN validity status was noted; a transcript was created to review. |

| 996 | Follow-up on Uncollectible | Internal action to follow up on debt marked as uncollectible. |

| 998 | Update Entity Information | Entity (personal/business) information was updated. |

SO based on this. Should I hear something tomorrow or the next day? I filed in February and have been waiting. I did get a hold of somebody at the IRS a few weeks ago and it sounds like they were missing a 1099R. Since the date next to the 570 code is a future date what does that mean?

570 Additional account action pending 03-30-2020