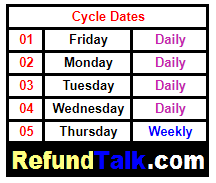

A cycle code is an 8 digit code found on your account transcripts. The cycle code indicates the day your account was posted to the IRS Master File. This date indicates the 4 digits of the current cycle year, two-digit IRS cycle week, and two-digit processing day of the week.

Cycle Code Breakdown

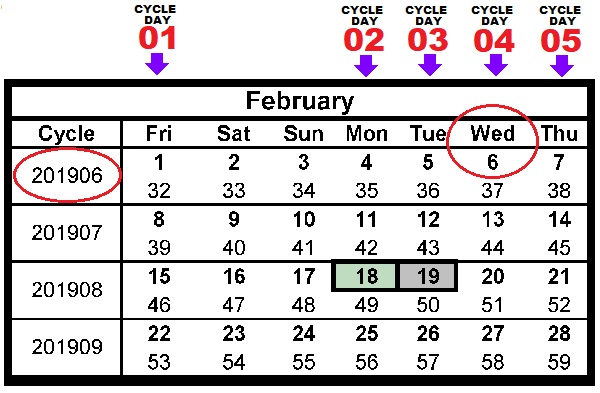

Example: 20190604 = (2019 – Cycle Year) (06 – Cycle Week) (04 – Cycle Day) = Wednesday, February 6, 2019

Here is an example of cycle code20190604on the 2019 IRS Posting Cycles

20190604 = (201906 – Cycle)(04 – Processing Day) = Wednesday, February 6, 2019

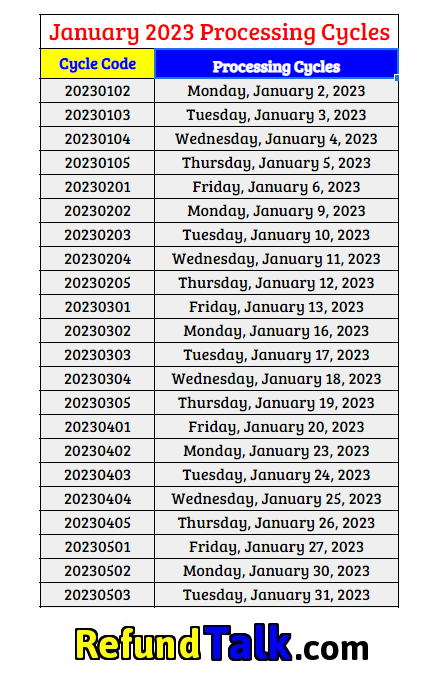

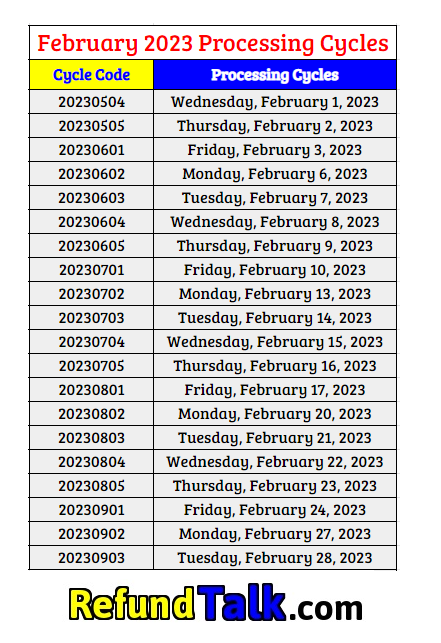

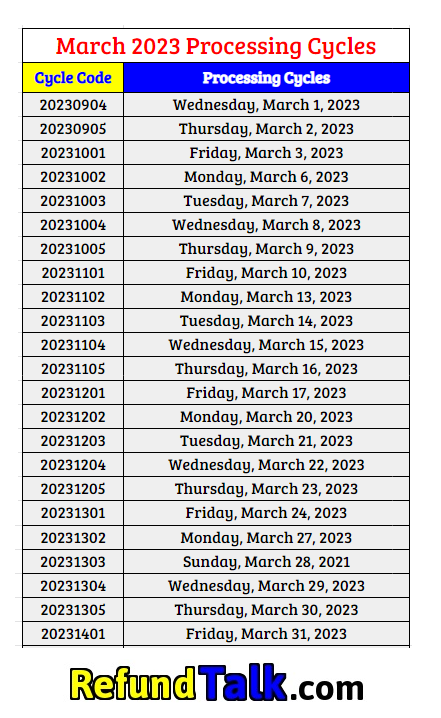

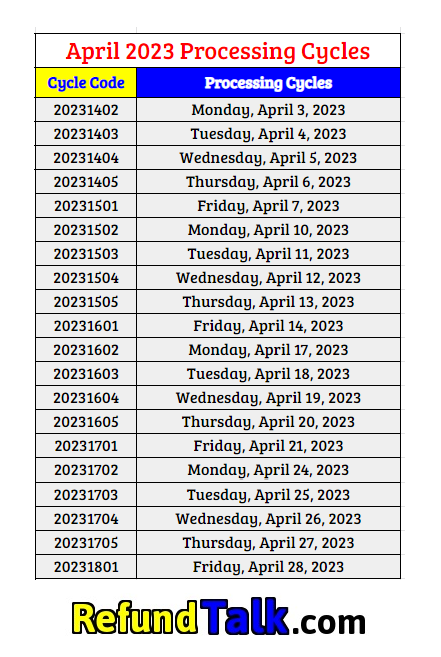

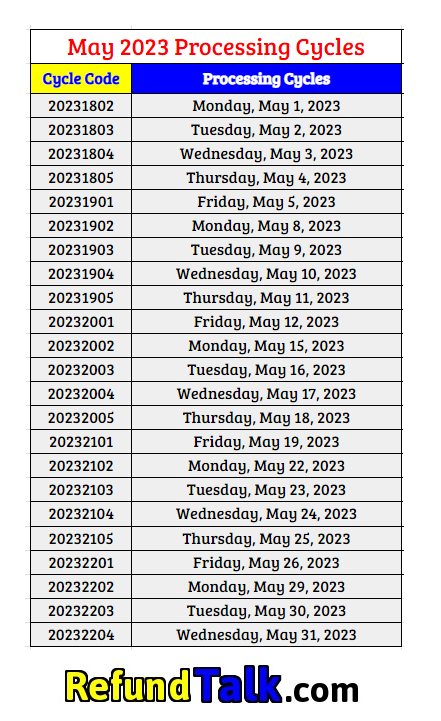

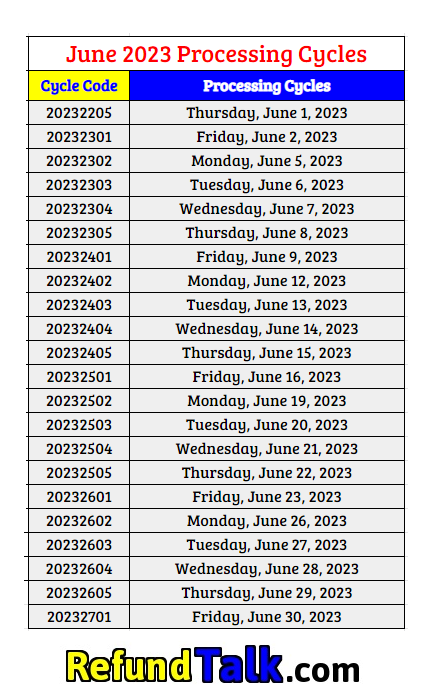

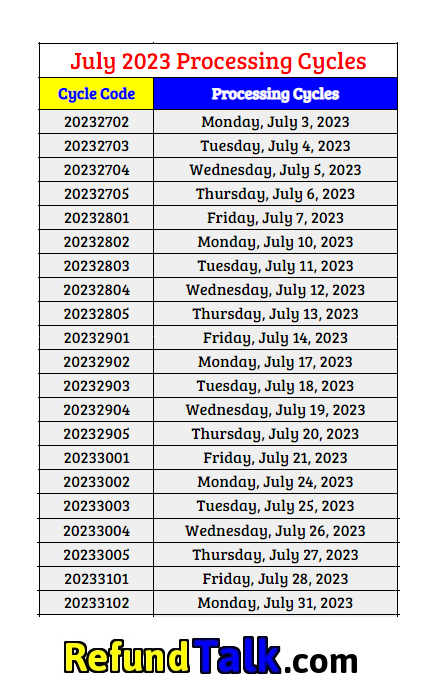

2023 IRS Processing Cycles

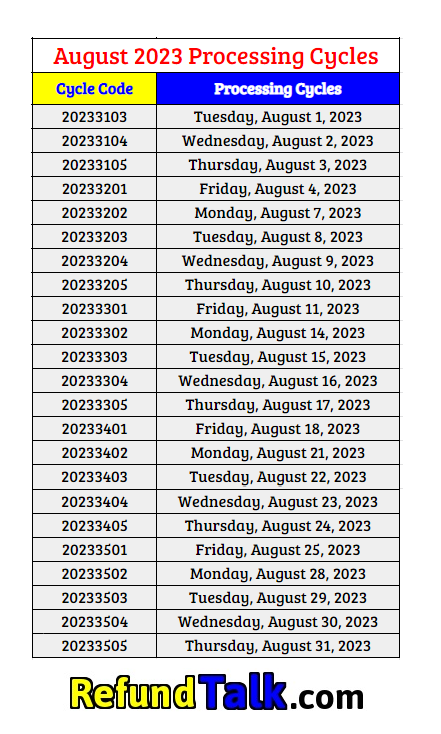

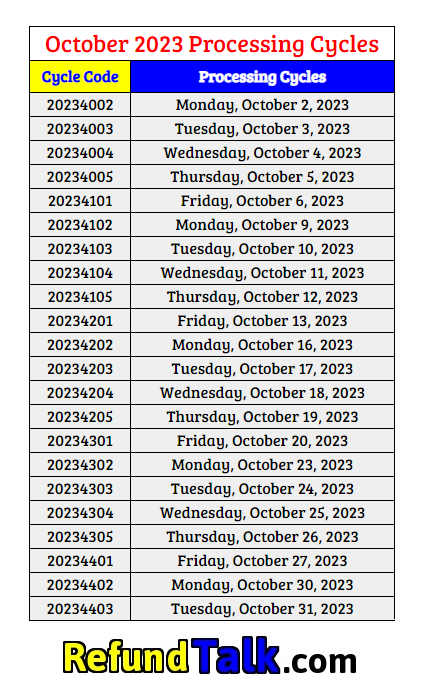

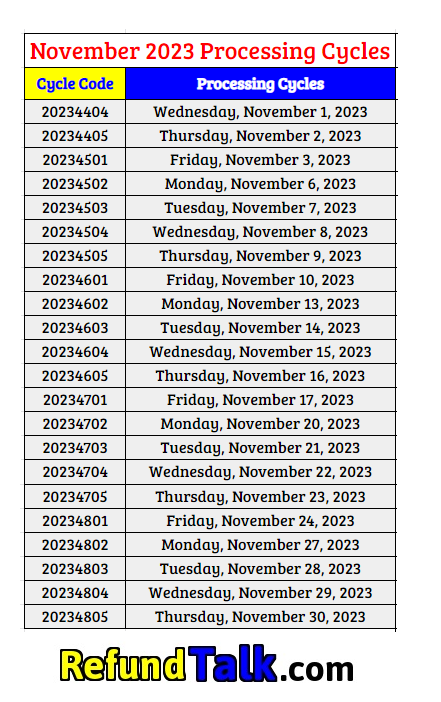

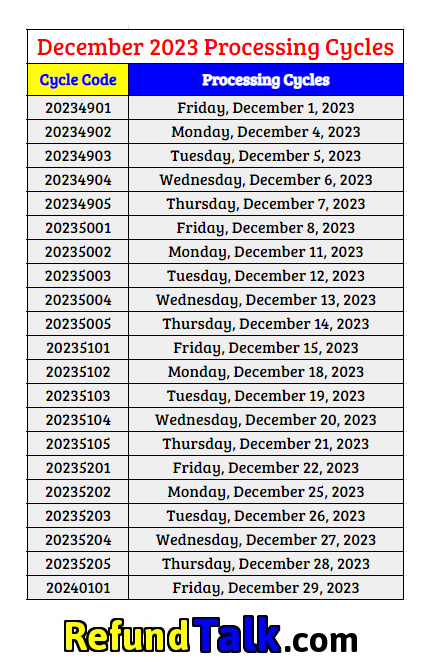

We have simplified the IRS Posting Cycles from above to make them easier to read. All you have to do is find your cycle code on your account transcript and use these charts below to determine the day the IRS began to process your tax return.

2023 Transcript Cycle Code Charts

January 2023 IRS Processing Cycles

February 2023 IRS Processing Cycles

March 2023 IRS Processing Cycles

April 2023 IRS Processing Cycles

May 2023 IRS Processing Cycles

June 2023 IRS Processing Cycles

July 2023 IRS Processing Cycles

August 2023 IRS Processing Cycles

September 2023 IRS Processing Cycles

October 2023 IRS Processing Cycles

November 2023 IRS Processing Cycles

December 2023 IRS Processing Cycles

Find Your IRS Cycle Code Schedule

Each year has its own IRS posting cycle. Use the links below to access full cycle calendars and expected update days to better understand your tax transcript timing.

Go to Transcript Hub