If you’ve been checking your IRS tax transcripts and noticing that refund dates look farther out than in past years, you’re not imagining things. What you’re seeing reflects a shift in how the IRS sequences refund release and deposit dates, not the disappearance of the familiar weekly vs. daily processing cycles.

In short: the rules didn’t vanish — the timing strategy changed.

What Changed in Practice

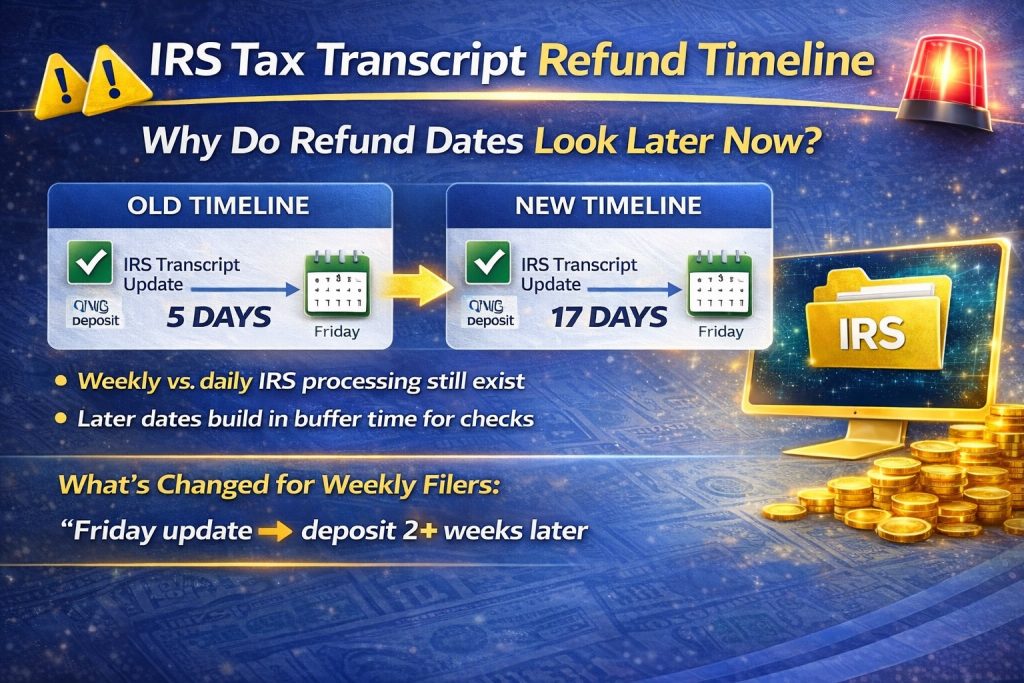

In prior tax seasons, many taxpayers on weekly processing cycles (cycle codes ending in 05) experienced a fairly predictable pattern:

- A Friday transcript update

- A refund date about 5 days later

- Direct deposit often landing the following Wednesday

This pattern became widely recognized because, for many filers, it accurately reflected when money actually arrived.

What’s different now (2025 and into early 2026)

For recent processing periods, especially in 2025 returns and early 2026 activity, weekly-cycle taxpayers are commonly seeing:

- A Friday transcript update

- A refund date 14–21 days out

- With 17 days being a frequent window (for example: Friday update → refund date about 2½ weeks later)

The weekly update cycle still exists, but the refund date posted on the transcript is now more conservative.

Why IRS Transcripts Look “Slower” Now

The key reason is system separation and risk management.

While the Account Transcript (Master File / AMS) still updates on daily or weekly schedules, refund issuance itself flows through separate systems, including:

- The Refund Processing System

- The Bureau of the Fiscal Service (Treasury)

These systems operate independently of the transcript update schedule.

Why the IRS posts later refund dates

The IRS appears to be intentionally building in extra buffer time to account for:

- Internal processing steps

- Identity verification and fraud screening

- PATH Act, EITC, and ACTC holds

- Treasury disbursement timing

By posting farther-out refund dates, the IRS reduces the risk of:

- Missed dates

- Taxpayer confusion

- Increased calls and complaints

As a result, the transcript refund date is now often best understood as a “no later than” estimate, not a guaranteed payday.

Some taxpayers still receive deposits before the posted date, while others land on or shortly after it.

Daily vs. Weekly Accounts: What Still Applies

Daily accounts

- Can still see faster transcript and WMR movement

- Refund dates often align more closely with actual deposits

Weekly accounts

- Still batch-update Thursday night / Friday

- But the refund date is no longer a near-term 5-day window

- Instead, it reflects a 17 day (2+ week cushion)

This is why weekly filers feel like things have slowed — even though the underlying cycle hasn’t changed.

How to Interpret Refund Dates Going Forward

For planning, education, and expectation-setting, the safest approach now is:

- Treat the transcript refund date as a conservative outer estimate

- Pair transcript checks with:

- Where’s My Refund

- Bank account monitoring

- Understand that earlier deposits are still possible, but no longer guaranteed

A Simple Way to Explain This to Taxpayers

“In past seasons, a Friday weekly transcript update with a date 5 days out was often your real payday. Now, weekly transcripts usually show a refund date about 17 days out. That date acts as a built-in cushion. Some people still get their money earlier, but the IRS is deliberately posting safer, later dates so they’re less likely to miss them.”

Nothing is “broken,” and weekly processing hasn’t disappeared. The IRS has simply adjusted how refund dates are communicated on transcripts to better match modern processing, verification, and Treasury timing.

Understanding this shift helps set realistic expectations — and avoids unnecessary stress while waiting for refunds.