The Protecting Americans from Tax Hikes (PATH) Act required the IRS to hold all refunds for returns claiming the earned income tax credit (EITC) and additional child tax credit (ACTC) until February 15.

PATH ACT LAW! – By law, the IRS cannot issue refunds for people claiming the Earned Income Tax Credit (EITC) or Additional Child Tax Credit (ACTC) before February 15th. The law requires the IRS to hold the entire refund — even the portion not associated with EITC or ACTC. The IRS expects the earliest EITC/ACTC related refunds to be available in taxpayer bank accounts or debit cards starting the first week of March 2026, if direct deposit was used and there are no other issues with the tax return. This additional period is due to several factors, including the Presidents Day holiday and banking and financial systems needing time to process deposits. This law change, which took effect at the beginning of 2017, helps ensure that taxpayers receive the refund they’re due by giving the IRS more time to detect and prevent fraud.

What impact does PATH ACT have on taxpayers?

This legislation will create funding delays of up to six weeks or more for an estimated 30M taxpayers filing at the beginning of the tax season. As much as $100B+ in federal tax refunds may be delayed.

Why Is The Delay Happening?

On December 18, 2015, Congress passed the PATH (Protecting Americans from Tax Hikes) Act which made over 20 tax provisions permanent, including tax credit expansions to the EITC, ACTC, and American Opportunity Tax Credit (AOTC) that were set to expire in 2017. The PATH Act also requires a change in the issuing of EITC and ACTC refunds.

No refund will be made to a taxpayer before February 15 if the taxpayer claimed the Earned Income Tax Credit or Additional Child Tax Credit on the return. This will allow the IRS to verify income reported on those returns since employers are now required to file W-2 forms and 1099s by January 31 (previously they had until March).

Most refunds are expected to be issued within 21 days of processing. If the IRS identifies significant mismatches between the income information provided on the return and provided by employers, there can be additional delays as the IRS seeks to resolve the mismatch.

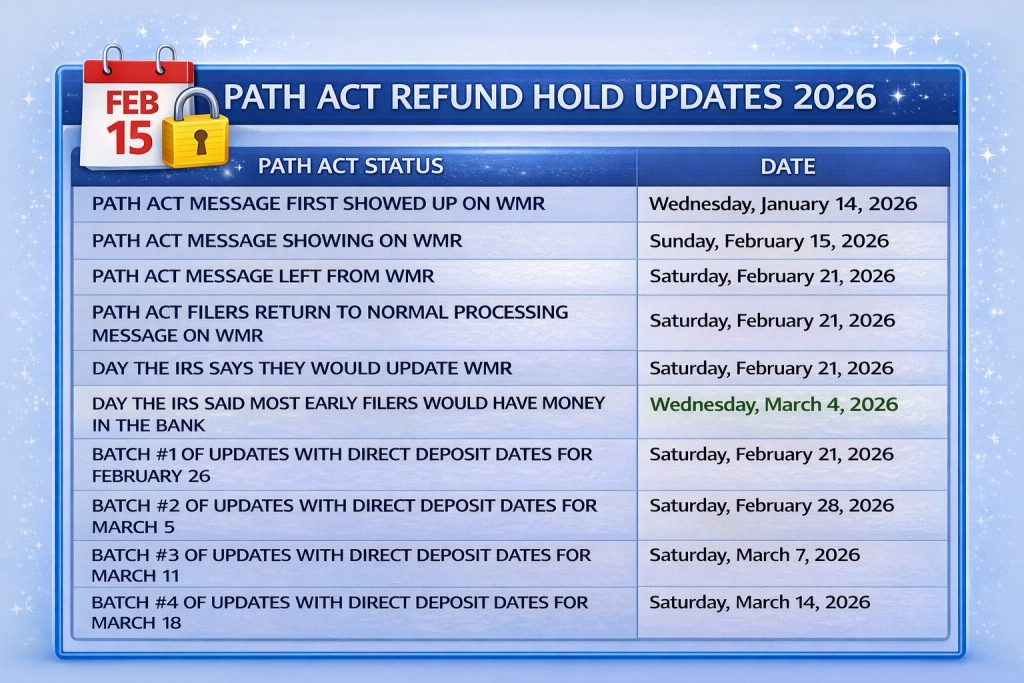

Is 2026 the last year for the PATH Message delay for tax filers prior to Feb. 15?

No, The PATH Act law makes the Earned Income Tax Credit(EITC) and Additional Child Tax Credit(ACTC) expansionpermanent, when the bill was passed in 2015 it was intended to remain unchanged indefinitely. This measure is accompanied by several anti-fraud provisions, to help alleviate the credit’s high rate of improper payments.

Why do I have the PATH message when I check my refund status?

Check over page two of your 2025 1040 Form. Check to see if you see an amount for Earned Income Credit (line 18a), Additional Child Tax Credit (line 18b) if nothing is on ANY of those lines, your tax refund will NOT be affected by the PATH message.

If you have an amount on ANY of those lines, you could see the PATH message until after February 15th.

What if I never got the PATH Message?

Those refunds will be issued after your return completes processing, provided you owe no other liability.

Could my refund status change before Feb. 15 once I have the PATH message?

No, Once you have the PATH message you will not see any changes to your refund status until after February 15th.

If you are claiming Earned Income Credit or Additional Tax Credits and will be affected by the PATH Message. All returns claiming the two mentioned credits above will be held under a C-Freeze. When your return/refund is held under a C-Freeze this forces the tax return to update only on a weekly schedule. Everyone with the PATH message whether their cycle code ending in 01, 02, 03, 04, or 05 should see WMR updates on Saturdays. When a C-Freeze is on the account the computer forces the account to post updates on Where’s My Refund(WMR) on Saturdays.

What if I file my tax return after February 15th?

If you file taxes after February 15, the new tax law does not affect the timing of your tax refund. Those refunds will be issued after your return completes processing, provided you owe no other liability.

On February 16th why did my status change to Still Processing and No Direct Deposit Date?

Everybody’s Where’s My Refund? statuses will change to a new status because the PATH hold releases at the end of the day (11:59:59pm) on February 15th. Most people will see the Still Processing screen until they receive further information or two bars with a Direct Deposit Date.

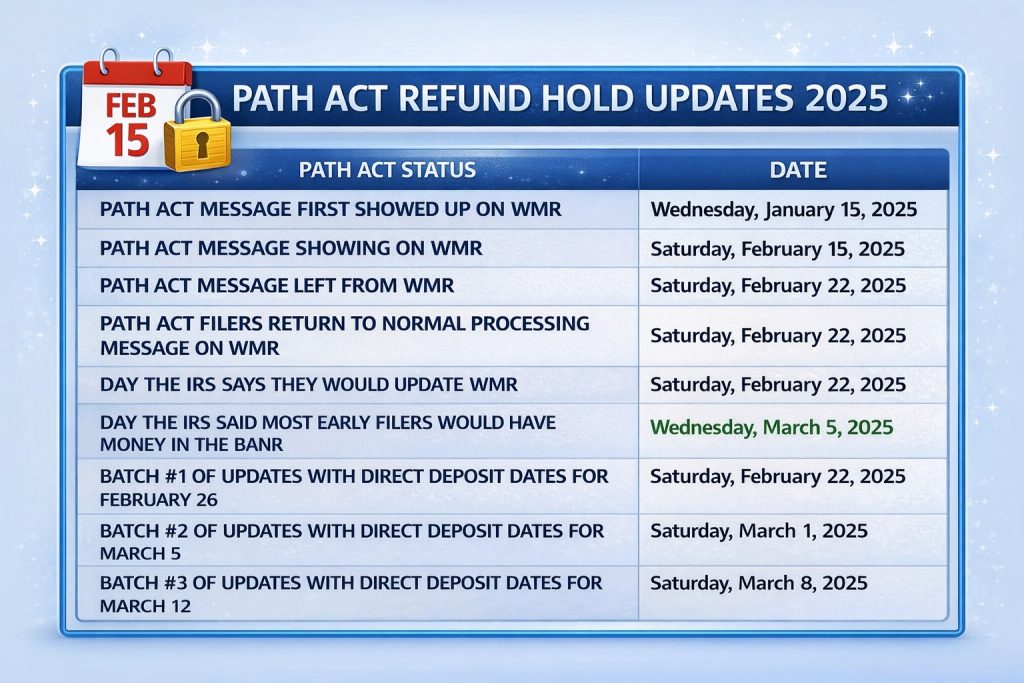

After the PATH ACT message, when did the first updates happen?

Our Prediction for when we could see the first updates in 2026!

When is the First batch of Direct Deposit Dates for PATH Filers on WMR in 2026?

The IRS “Where’s My Refund” tool will be updated with projected deposit dates for most early EITC and ACTC refunds by Saturday, February 21, 2026.

Can I get a Direct Deposit before Feb. 15th?

- All current year tax returns that claim EITC and/or ACTC filed before February 15th will contain a C- freeze on the account, to hold the refund.

- Prior to February 15th, the refund cannot be released:

- by inputting any type of adjustment to the account

- due to a hardship (hardships will not be considered as long as the C- freeze is on the account). This includes the part of the refund that is not associated with the EITC or ACTC.

- The C- freezes will be systemically released on February 15th for modules processed daily, and on the first Thursday after February 15th for modules processed weekly. If February 15th falls on a Thursday, both daily and weekly modules will be systemically released on the 15th.

If my cycle code is daily will I update from Path on Wednesday Morning?

No, If you claimed EITC and/or ACTC the system generates a Posting Delay C-Freeze Code on transactions resulting in the transaction being held until the weekly processing cycle meaning you will see refund updates on WMR on Saturday Mornings.

Does the PATH ACT Message mean I am done processing?

No, the PATH ACT message doesNOTmean you are done processing. It verifies that you have been accepted and are processing and you will not have a confirmation of your status until

- AFTER February 15th as the message says or

- When you receive a letter in the mail from the IRS or

- When you wake to a deposit in your account.

Prior to February 15th, the refund cannot be released for any reason.

PATH ACT Facts

- File as you normally do. You do not need to change the way you file your tax return, including where you get your taxes done.

- The delay applies to all methods of tax filing – at a commercial tax preparer or self-preparation. No one can provide your refund before February 15. There are no exceptions.

- The purpose of the refund delay is to help protect you and your refund.

- Beware of offers of loans against delayed refunds, such as a loan on a refund claim based on a year-end

pay stub instead of a W-2. Loan fees are expensive and the return may be inaccurate without all income information, but the loan must be repaid. - While the delay applies specifically to tax filers claiming the EITC and ACTC, it will affect your entire refund, including refunds based on over withholding or other tax credits. You cannot receive a partial refund.

- Everyone is not affected by the delay. Taxpayers claiming the EITC and ACTC who file returns after February 15 will not be impacted. Additionally, early filers who are ineligible to claim the EITC or ACTC will not be affected. Refunds based only on over withholding or other tax credits will not be held.