If you filed your tax return early and expected instant updates, you’re not alone. Every year, early filers flood refund forums asking the same questions:

- Why hasn’t my refund moved?

- Why does Where’s My Refund still say “processing”?

- Why do my transcripts show nothing yet?

Here’s the truth most people don’t realize:

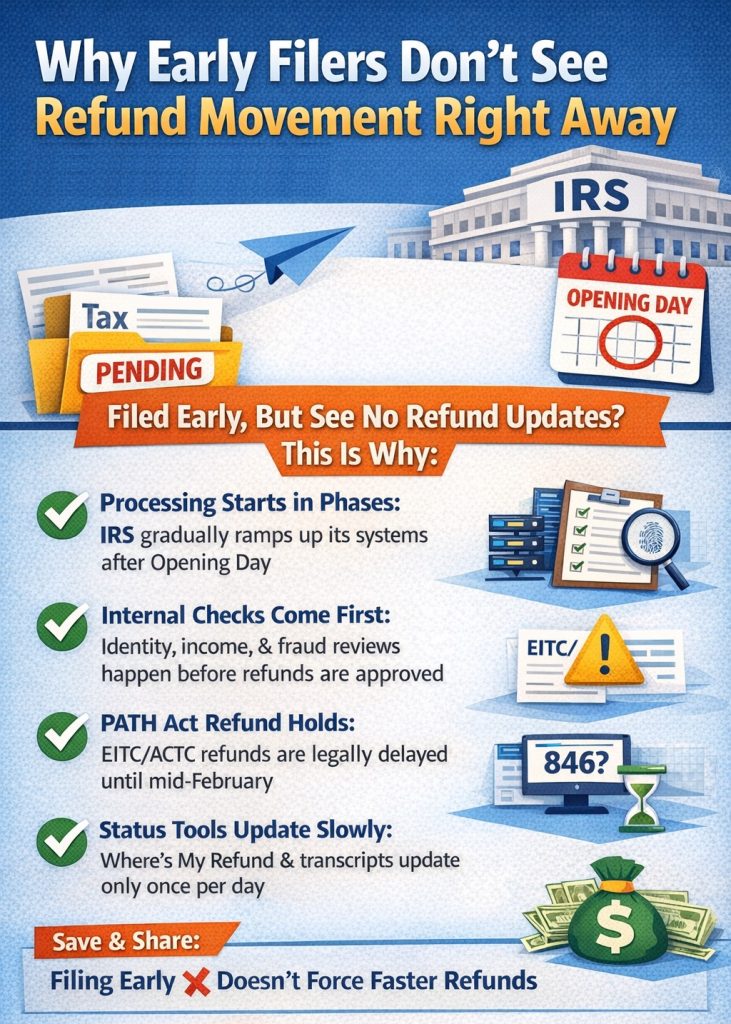

Filing early puts you in line — it does not trigger instant refund movement.

The IRS processes returns in phases, not all at once, and several built-in delays affect what you see (and when).

Let’s break it down clearly.

The IRS Doesn’t Pay Refunds Until After Opening Day

One of the biggest misconceptions is that the IRS starts processing refunds the moment returns are accepted.

That’s not how it works.

- Returns filed before IRS Opening Day are accepted and held

- They sit in a secure queue

- Full processing does not begin until the IRS officially opens the filing season

This means the familiar “up to 21 days” refund timeline does NOT start when you file early — it starts when IRS processing actually begins.

So if you filed very early, it’s completely normal to see no movement for days or even weeks, even though your return was accepted.

IRS Systems Ramp Up in Phases — Not All at Once

At the start of every filing season, the IRS gradually activates systems, filters, and review programs.

Think of it like turning on a massive factory:

- Machines don’t all start at the same time

- Output increases in waves

- Bottlenecks are normal early on

Early filers are often waiting while the IRS:

- Balances system load

- Verifies incoming data

- Clears internal backlogs

This “warm-up” period happens every year — and it’s invisible to taxpayers.

Internal Checks Come Before Refund Approval

Before any refund can be approved, the IRS must complete several behind-the-scenes checks, including:

- Identity verification

- Wage and income matching (W-2s, 1099s)

- Basic math and error screening

- Fraud and duplicate return checks

When filing volume is extremely high at the start of the season, these reviews can take longer to clear.

That’s why:

- Where’s My Refund may say “processing” with no change

- Transcripts may show little or no activity

- Nothing looks like it’s happening — even when it is

EITC and ACTC Refunds Are Legally Delayed

If your return includes:

- Earned Income Tax Credit (EITC) or

- Additional Child Tax Credit (ACTC)

Your refund is subject to a legal hold under the PATH Act.

By law, the IRS cannot issue these refunds until mid-February, no matter how early you file or how perfect your return is.

The IRS has repeatedly stated that:

- Most EITC/ACTC refunds are not released until late February

- Early January filers will still wait

- No workaround exists

This delay is not an error — it’s federal law.

Status Tools Update Slower Than Processing

Another major frustration point is IRS status tools.

Here’s what many people don’t realize:

- Where’s My Refund updates once per day

- Transcript changes typically post overnight

- Updates are not real-time

As a result:

- Internal processing may already be happening

- Refund approval may be approaching

- But the public tools still show no visible change

This lag creates the illusion of “no movement,” even when progress is being made.

Early Filing vs. Realistic Expectations

Early filers often believe they’ll be the first paid — but in reality:

- Most error-free e-filed returns are paid within a similar 21-day window

- Filing early mainly helps you avoid last-minute delays

- It does not bypass IRS reviews, legal holds, or system timing

Early filing is smart — but it’s not magic.

The Bottom Line

✔ Filing early gets you in line

✔ It reduces risk of late-season delays

✔ It does NOT guarantee instant updates

✔ It does NOT override legal refund holds

✔ It does NOT force faster processing cycles

If your refund hasn’t moved yet, that doesn’t mean something is wrong. In most cases, it means the IRS system is working exactly as designed.