IRS Systems Are “Warming Up” — Here’s What That Really Means

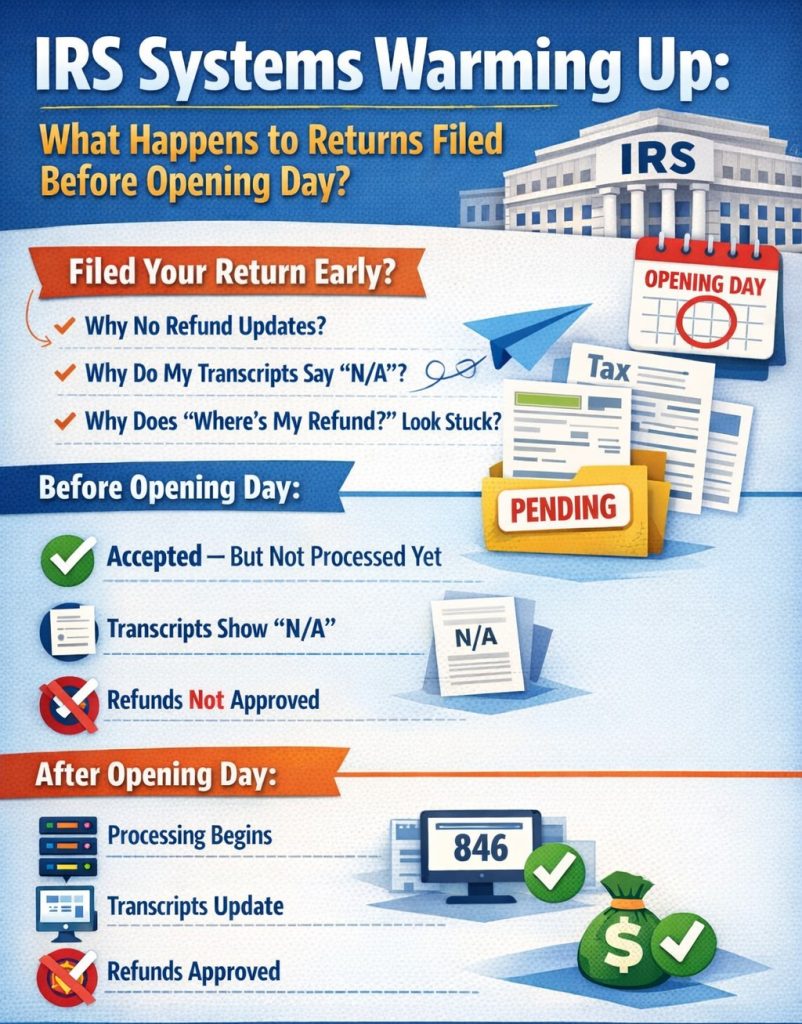

Every year, millions of taxpayers rush to file their tax returns as soon as their software allows. But if you filed before IRS Opening Day, you may be wondering:

- Why hasn’t my refund moved?

- Why do my transcripts still say “N/A”?

- Why does Where’s My Refund? look stuck?

The answer is simple—and important to understand:

The IRS accepts early returns, but does not process them until Opening Day.

This pre-season phase is often referred to as the IRS “system warm-up” period.

What Is IRS Opening Day?

IRS Opening Day is the official date when the IRS begins full processing of individual tax returns.

- Before Opening Day:

✔ Returns can be submitted and accepted

✖ Returns are not processed

✖ Refunds are not approved or issued - On and after Opening Day:

✔ IRS systems activate full processing

✔ Returns enter the Master File

✔ Refund timelines officially begin

What Happens to Returns Filed Before Opening Day?

If you file early, your return goes into a secure holding queue. Here’s exactly what happens behind the scenes:

1. Your Return Is Accepted — But Only Validated

An “Accepted” status means:

- Your return passed basic checks

- Your Social Security number is valid

- Required fields are complete

Accepted ≠ Processed

2. Your Return Waits Outside the IRS Master File

Before Opening Day:

- Returns do not post to IRS transcripts

- No refund calculations occur

- No audit, review, or PATH Act checks begin

This is why:

- Account transcripts show “N/A”

- No transaction codes appear

- Refund tools don’t update

3. Processing Starts After Opening Day

Once Opening Day arrives:

- Returns are released in batches

- Daily and weekly cycle processing begins

- Refund approvals (Code 846) start appearing

Your refund clock starts on Opening Day, not the day you filed early.

Why the IRS Uses a “Warm-Up” Period

The IRS uses this staged approach to:

- Test internal systems (Controlled Launch / HUB Testing)

- Reduce system crashes

- Prevent refund fraud

- Ensure all tax forms are fully activated

Early filing helps you, but the IRS still controls when processing begins.

Common Early-Filer Myths (Debunked)

“I filed early, so I’ll get my refund first.”

Not necessarily. Processing order depends on IRS cycles, not submission time alone.

“Accepted means my refund is approved.”

No. Approval only happens after processing begins.

“Something is wrong because my transcript hasn’t updated.”

Normal before Opening Day.

When Will Early Filers See Movement?

Most early filers will notice:

- Transcript updates within 1–2 weeks after Opening Day

- Refund approvals within 21 days of processing start

- PATH Act returns held until after February 15, regardless of filing date

What You Should Do If You Filed Early

✔ Be patient — no action needed

✔ Monitor transcripts after Opening Day

✔ Ignore refund rumors before processing starts

✔ Avoid re-filing or amending unnecessarily

Early filing is smart—but understanding the timeline prevents stress.

Bottom Line

IRS systems don’t “wake up” all at once.

Returns filed before Opening Day are safely accepted, held, and then released for processing once the IRS officially opens the season.

If your refund hasn’t moved yet, that doesn’t mean there’s a problem—it means the system is doing exactly what it’s designed to do.